UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

| | |

| American International Group, Inc. |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11.

| | | | | |

| |

A Letter from our Chairman & Chief Executive Officer | |

| |

| | | | | |

Peter Zaffino

Chairman & Chief Executive Officer

| Dear Fellow Shareholders: |

|

As we approach AIG’s 2023 Annual Meeting of Shareholders, I would like to share highlights from 2022, a year where we made significant progress across our strategic priorities and delivered significant value to our shareholders and other stakeholders.

Our most significant accomplishment last year was completing the Initial Public Offering (IPO) of Corebridge Financial, Inc. (Corebridge) in September. We completed the IPO, the largest in the United States in 2022, notwithstanding significant volatility and complexity in the equity capital markets.

We also made significant progress on the operational separation of Corebridge from AIG, including creating Investment groups for each company with investment strategies aligned to their businesses. Over the last couple of years, we entered into strategic partnerships with Blackstone and BlackRock, and are benefiting from their scale and investment expertise. Through the end of 2022, we transferred approximately $50 billion and $150 billion of assets, respectively, to these partners.

Separately, our multi-year effort to remediate the General Insurance portfolio led to significant improvement in the financial results of this business over the last few years and, particularly in 2022, which resulted in the strongest underwriting profitability AIG has ever achieved. Underwriting income was $2 billion, representing the second consecutive year with $1 billion or more of earnings improvement. Our General Insurance global portfolio has been completely overhauled and is well positioned for continued profitable and sustainable growth.

With respect to the balance sheets of AIG and Corebridge, throughout 2022, we executed on multiple capital market transactions to establish a strong balance sheet for Corebridge as a standalone company while strengthening AIG’s balance sheet. These actions, coupled with our impressive financial performance in 2022, allowed us to return over $6 billion to shareholders through $5.1 billion of share repurchases and $1 billion of dividends while reducing AIG’s debt outstanding by over $9 billion.

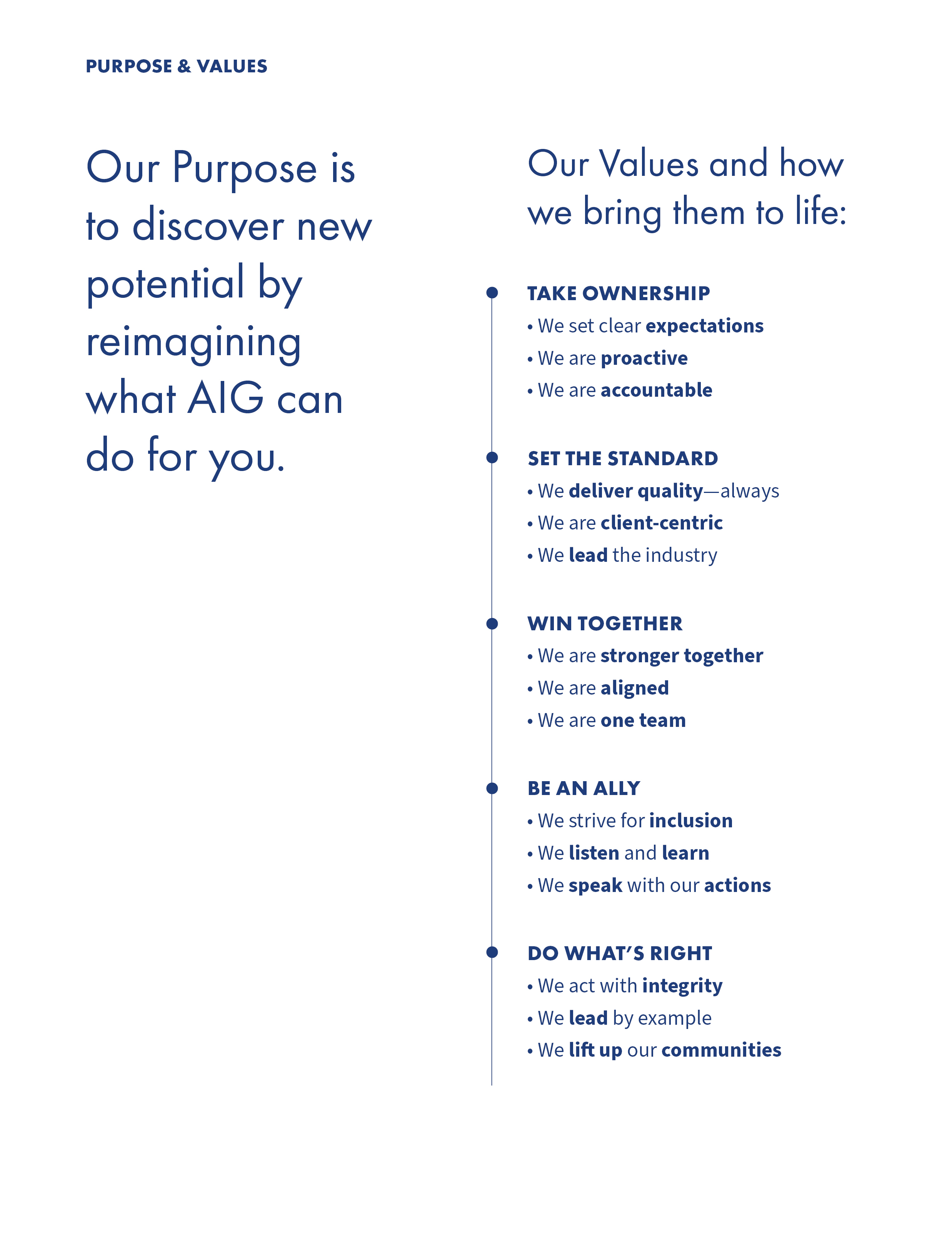

Additionally, in March 2022, we introduced a new Purpose statement for AIG: “To Discover New Potential by Reimagining What AIG Can Do For You,” which demonstrates our optimism about the future and how we plan to continue leading the industry, enabling progress, and delivering value in an ever-changing and increasingly complex landscape. This Purpose statement is underpinned by five core values: Take ownership, Set the standard, Win together, Be an ally, and Do what’s right. Committing to our values at every level of the organization and embedding them in our day-to-day interactions is critical to strengthening AIG's culture of continuous improvement and aligning behaviors around shared goals, particularly as we look to the future state of AIG post de-consolidation of Corebridge.

|

AIG 2023 PROXY STATEMENT1

| | | | | |

| With respect to the AIG Board of Directors, since our last Annual Meeting of Shareholders, we continued our thoughtful approach to director refreshment. John Rice, who joined the Board in March 2022, assumed the role of Lead Independent Director in January 2023. John is an experienced former senior executive, a seasoned public company director, and a thoughtful and respected member of AIG’s Board. We also added three new directors and built a strong pipeline of candidates for the future. We were pleased to welcome Paola Bergamaschi in December 2022 and more recently, Diana Murphy and Vanessa Wittman, in March 2023. All three bring unique skills, experience, and personal attributes that will enhance the effectiveness of our Board. More information about each of our director nominees can be found in this Proxy Statement.

As previously announced, Doug Steenland, who served as a director since 2009, Non-Executive Chairman from 2015 until 2021, and Lead Independent Director through 2022, decided not to stand for re-election this year. In January 2023, we announced that Tom Motamed decided to retire from the Board for health reasons. And, earlier this month, we announced that Jerry Jurgensen, a director since 2013, decided to retire and not stand for re-election at the 2023 Annual Meeting. We and our stakeholders benefited from having Doug, Tom and Jerry on the Board of Directors, and, on behalf of all AIG directors, I want to thank them for their many contributions.

The Board encourages you to read this Proxy Statement and the accompanying Annual Report, and we welcome you to join AIG’s virtual Annual Meeting of Shareholders at www.virtualshareholdermeeting.com/AIG2023 on Wednesday, May 10, 2023, at 11:00 a.m. Eastern Time.

Thank you for your continued investment in and support of AIG. I am very optimistic about our future as we continue AIG's journey to become a top performing company delivering excellence in all that we do.

Sincerely,

Peter Zaffino Chairman & Chief Executive Officer | Dear Fellow Shareholders: |

|

I am very pleased with the progress AIG made in 2023 and will highlight our significant achievements throughout the year. Our sustained financial performance over the last several years has enabled us to continue to position AIG as a top-performing global insurer. Over the course of the year, we made significant strategic, operational and financial advancements, which created substantial value for AIG’s colleagues, clients, and shareholders, and provided significant momentum as we enter 2024. Our very strong financial results last year were led by excellent underwriting performance, expense discipline as we continued investing for the future, increased investment income, and execution of a balanced capital management strategy. In 2023, we delivered exceptional underwriting profitability that surpassed our 2022 results and delivered a second consecutive year of underwriting income in excess of $2 billion. To put this in context, AIG had significant underwriting losses from 2008-2018, making today’s performance even more impressive. Now, we are well positioned with our breadth and depth of expertise and talent in underwriting, operational capabilities, and claims service to drive AIG’s continued progress. During 2023, we also reached several important milestones by simplifying our business, executing on several divestitures that further re-positioned our portfolio, and significantly reducing volatility. We made remarkable progress towards the separation of Corebridge, completing three secondary offerings that generated approximately $2.9 billion in proceeds. At year end, our ownership stake in Corebridge was approximately 52%, and we expect to continue reducing our ownership of Corebridge in 2024, subject to market conditions. When we are not the majority owner of Corebridge and no longer control its board, we will no longer consolidate our financial results, and this will enable us to be positioned as a leading global property and casualty insurer. Our outstanding performance and strategic positioning in 2023 enabled the execution of our thoughtful and balanced capital management strategy. We increased financial flexibility while reducing debt by $1.4 billion and returning approximately $4 billion to AIG shareholders through $3 billion of common stock repurchases and $1 billion of common stock dividends, including a 12.5% increase in the second quarter of 2023. We finished 2023 with very strong parent liquidity of $7.6 billion, giving us ample capacity to continue executing on our capital management priorities going forward. AIG entered 2024 with strong momentum and we have introduced AIG Next, our future-state business model that will create additional value by weaving a leaner, more unified company together. AIG Next will result in further expense reductions and will support our progress toward achieving our Adjusted Return on Common Equity target of 10% plus, while also creating a less complex company. We are able to deliver multiple high-quality outcomes while moving with pace thanks to the commitment and teamwork of our AIG colleagues around the world. As you will hear from the Board’s Lead Independent Director, John Rice, we enhanced our governance practices in 2023, anchored by active engagement with AIG’s investors and continued refreshment of our Board of Directors. Since our last shareholder meeting in May 2023, the Board welcomed two highly accomplished and eminently qualified Directors, Jimmy Dunne and Chris Inglis. The Board encourages you to read this Proxy Statement and the accompanying Annual Report, and we welcome you to join AIG’s virtual Annual Meeting of Shareholders at www.virtualshareholdermeeting.com/AIG2024, on May 15, 2024, at 11:00 a.m. Eastern Time. AIG is well positioned to help our clients and partners solve a vast array of risk issues while working closely with our stakeholders to navigate an increasingly complex global socioeconomic environment. All of our stakeholders have recognized that we are now setting the standards in the global insurance industry. I thank you for your continued investment of capital and support, and I look forward to continuing to build on the progress we have made as we create the AIG of the future and provide exceptional value to our stakeholders. Sincerely, Peter Zaffino Chairman & CEO |

AIG 2024 PROXY STATEMENT1

| | |

|

A Letter from our Lead Independent Director |

|

| | | | | |

John G. Rice Lead Independent Director | Dear Fellow Shareholders: |

|

I joined AIG’s Board in 2022 and have been honored to serve as Lead Independent Director since January 1, 2023. AIG management and the Board communicate openly and candidly so that the Board can effectively perform its role. Our meeting agendas are established with the Chairman and CEO and designed to ensure we spend time on the most important matters including both opportunities and challenges. We have executive sessions as part of every meeting, and there is regular director interaction between meetings so questions can be posed, and ideas can be shared. The Board makes an effort to engage consistently and productively with shareholders. This engagement was substantial again this year, with outreach to investors representing 68.9% of shares outstanding and resulting meetings with those representing 54.3% of shares outstanding. Following feedback from investors at these meetings, the Board completed a comprehensive review and update of AIG’s Corporate Governance Guidelines, which led to broader duties for the Lead Independent Director. We have added two new directors who will be standing for reelection, along with the rest of the Board, at this year’s Annual Meeting. With the addition of Jimmy Dunne and Chris Inglis, the Board stands to benefit from these executives’ business acumen, diverse experience in complex strategic initiatives, and deep commitment to the company. These individuals bring complementary skillsets while also understanding that the Board, as a whole, must be greater than the sum of its parts. Simply stated, our job is to work as a team to represent your interests and support the management team. As Peter has shared, AIG’s strategic, operational and financial momentum continues, thanks to the hard work of the leadership team and their colleagues around the world. In Peter Zaffino, we have an exceptional leader who is building the team, and the Company, for the future. Your Board will continue to evolve by regularly assessing our performance, seeking shareholder feedback, and working to ensure our efforts are commensurate with what our shareholders expect. Thank you for your continued support of AIG. The Board encourages you to read this Proxy Statement and welcomes you to join AIG’s virtual Annual Meeting of Shareholders at www.virtualshareholdermeeting.com/AIG2024 on Wednesday, May 15, 2024, at 11:00 a.m. Eastern Time. Sincerely, John G. Rice Lead Independent Director |

2 AIG 20232024 PROXY STATEMENT

| | | | | |

| |

Notice of

Annual Meeting

of Shareholders | 20232024 Annual Meeting of Shareholders to be Held Virtually:

This year’s meeting will be held in a virtual format only. Please visit www.virtualshareholdermeeting.com/AIG2023AIG2024 Date and Time:

May 10, 2023

15, 2024 11:00 a.m. Eastern Time |

| |

March 29, 2023April 2, 2024

Matters to be Voted On:

1.Election of the Ten Director Nominees Named in this Proxy Statement

2.Advisory Vote to Approve Named Executive Officer Compensation

3.Ratify Appointment of PricewaterhouseCoopers LLP (PwC) to Serve as Independent Auditor for 20232024

4.Consideration of the Two Shareholder ProposalProposals in this Proxy Statement, if Properly Presented at the Annual Meeting

5.Other business, if Properly Presented at the Annual Meeting

Your vote is very important. We encourage you to vote.

Who May Vote:

If you owned shares of AIGAmerican International Group, Inc. (AIG Parent) common stock at the close of business on March 13, 202318, 2024 (the record date), you are entitled to receive this Notice of the 20232024 Annual Meeting and to vote at the 20232024 Annual Meeting, either during the virtual meeting or by proxy.

How to Participate:

To participate in the 20232024 Annual Meeting via the website (www.virtualshareholdermeeting.com/AIG2023)AIG2024), enter the 16-digit voting control number found on your proxy card, voting instruction form, notice of internet availability of proxy materials, or email notification. You can find detailed instructions on page 9199 of this Proxy Statement. Please carefully review this Proxy Statement and vote in one of the four ways identified on this page under “How to Vote.”

By Order of the AIG Board of Directors.

Prabha Sipi BhandariChris Banthin

Senior Vice President Deputy General Counsel &and Corporate Secretary

How to Vote:

By Telephone

Call the telephone number on your proxy card or voting instruction form or in other communications

By the Internet

Go to www.proxyvote.com and follow the instructions

By Mail

Sign, date and mail your proxy card or voting instruction form in the enclosed envelope

Online During the Meeting

Attend the 20232024 Annual Meeting online. See page 92100 for instructions on how to attend and vote online

The Board of Directors of American International Group, Inc. (AIG or the Company)(the Board) is soliciting proxies to be voted at our 20232024 Annual Meeting of Shareholders on May 10, 2023,15, 2024, and at any postponed or reconvened meeting. We expect that the proxy materials and notice of internet availability will be mailed and made available to shareholders beginning on or about March 29, 2023.April 2, 2024.

AIG 20232024 PROXY STATEMENT 3

| | | | | |

| |

| A Letter from our Lead Independent Director | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held virtually on May 10, 2023.15, 2024. The Notice of the 20232024 Annual Meeting of Shareholders and Proxy Statement, as well as AIG’s 2022our 2023 Annual Report, are available free of charge at www.proxyvote.com or at www.aig.com. References in either document to our website are for the convenience of readers, and information available at or through our website is not a part of, nor is it incorporated by reference in, the Proxy Statement or Annual Report.

AIG'sOur principal executive offices are located at 1271 Avenue of the Americas, New York, New York, 10020-1304.

Note: In this Notice of the 2024 Annual Meeting of Shareholders and Proxy Statement, we use the terms the "Company," "AIG," "we," "us" and "our" to refer to AIG and its consolidated subsidiaries unless the context refers to AIG Parent only.

4 AIG 20232024 PROXY STATEMENT

| | | | | |

| |

| Proxy Statement Summary | | 2024 Annual Meeting of Shareholders to be Held Virtually: This year’s meeting will be held in a virtual format only. Please visit www.virtualshareholdermeeting.com/AIG2024 Date and Time:

May 15, 2024

11:00 a.m. Eastern Time |

| |

This summary highlights information contained in this Proxy Statement. It does not contain all of the information you should consider in making a voting decision, and you should read the entire Proxy Statement carefully before voting.

| | | | | | | | | | | | | | |

| Voting Matters and Vote Recommendation | Board’s recommendation | More information |

| | |

| | | | |

Management Proposals | Item 1 | Election of the Ten Director Nominees Named in this Proxy Statement | FOR each Director Nominee | |

| Item 2 | Advisory Vote to Approve Named Executive Officer Compensation | FOR | |

| Item 3 | Ratify Appointment of PricewaterhouseCoopers LLP to Serve as Independent Auditor for 2024 | FOR | |

| Shareholder Proposals | Item 4 | Proposal Requesting an Independent Board Chair Policy | AGAINST | |

| Item 5 | Proposal Requesting a Director Election Resignation By-Law | AGAINST | |

| | |

|

What's New nCorporate Governance Enhancements —Updates to Corporate Governance Guidelines – Completed a comprehensive review and update of our Corporate Governance Guidelines, including broadening the Lead Independent Director duties (see page 24) —Updates to Board committee charters – Completed a thorough review of each Board committee charter, which included benchmarking charters against certain companies in the Fortune 100 (see page 29) nEnhanced Disclosure - In response to shareholder feedback, we have enhanced our disclosures on the items below —Topics discussed during shareholder engagement, such as executive compensation, including one-time awards and talent succession (see page 35) —CEO succession planning (see page 27) —Board self-evaluation process (see page 25) —Board continuing education (see page 25) |

|

AIG 2024 PROXY STATEMENT5

Proxy Statement Summary About Us

About Us

We are a leading global insurance organization. We provide insurance solutions that help businesses and individuals in approximately 190 countries and jurisdictions protect their assets and manage risks through our operations and network partners.

| | | | | | | | |

| | |

World-Class Insurance Franchises that are among the leaders in their geographies and segments, providing differentiated service and expertise. | Breadth of Loyal Customersincluding millions of clients and policyholders ranging from multi-national Fortune 500 companies to individuals throughout the world. | Broad and Long-Standing Distribution Relationshipswith brokers, agents, advisors, banks and other distributors strengthened through our dedication to quality. |

| | |

| | |

Highly Engaged Global Workforceof more than 25,000 colleagues committed to excellence who are providing insurance solutions that help businesses and individuals in approximately 190 countries and jurisdictions protect their assets and manage risks through our operations and network partners. | Balance Sheet Strength and Financial Flexibilityas demonstrated by approximately $45 billion in shareholders’ equity and AIG Parent liquidity sources of $12.1 billion as of December 31, 2023. |

| | |

6AIG 2024 PROXY STATEMENT

Proxy Statement Summary 2023 Highlights

2023 Highlights

We delivered an outstanding year in 2023, producing strategic, operational and financial achievements that demonstrate continued strength in executing multiple, complex initiatives simultaneously and with quality.

| | | | | |

| |

Execution of Multiple, Highly Complex Strategic Initiatives nRepositioned our portfolio of businesses for sustainable, profitable growth with the divestitures of Validus Reinsurance, Ltd. (Validus Re) and Crop Risk Services, Inc. (CRS) and the transfer of Private Client Select to an independent Managing General Agent platform nClosed sale of Validus Re, including AlphaCat Managers Ltd. and the Talbot Treaty reinsurance business, for $3.3 billion in cash including pre-closing dividend nClosed sale of CRS for gross proceeds of $234 million nUnited the General Insurance and parent company leadership teams and their organizations nDebuted AIG Next, creating a leaner future-state business model and establishing enterprise-wide standards to drive better outcomes for all stakeholders | Continued Balanced Capital Management Supporting Financial Strength, Growth and Shareholder Return nRepurchased $3.0 billion of our common stock and paid $1.0 billion of common and preferred stock dividends nReduced weighted average diluted shares outstanding by 8 percent, reaching 725.2 million shares nIncreased quarterly common stock dividend payments by 12.5 percent $0.36 per share during the second quarter of 2023 nReduced general borrowings by $1.4 billion |

| |

| |

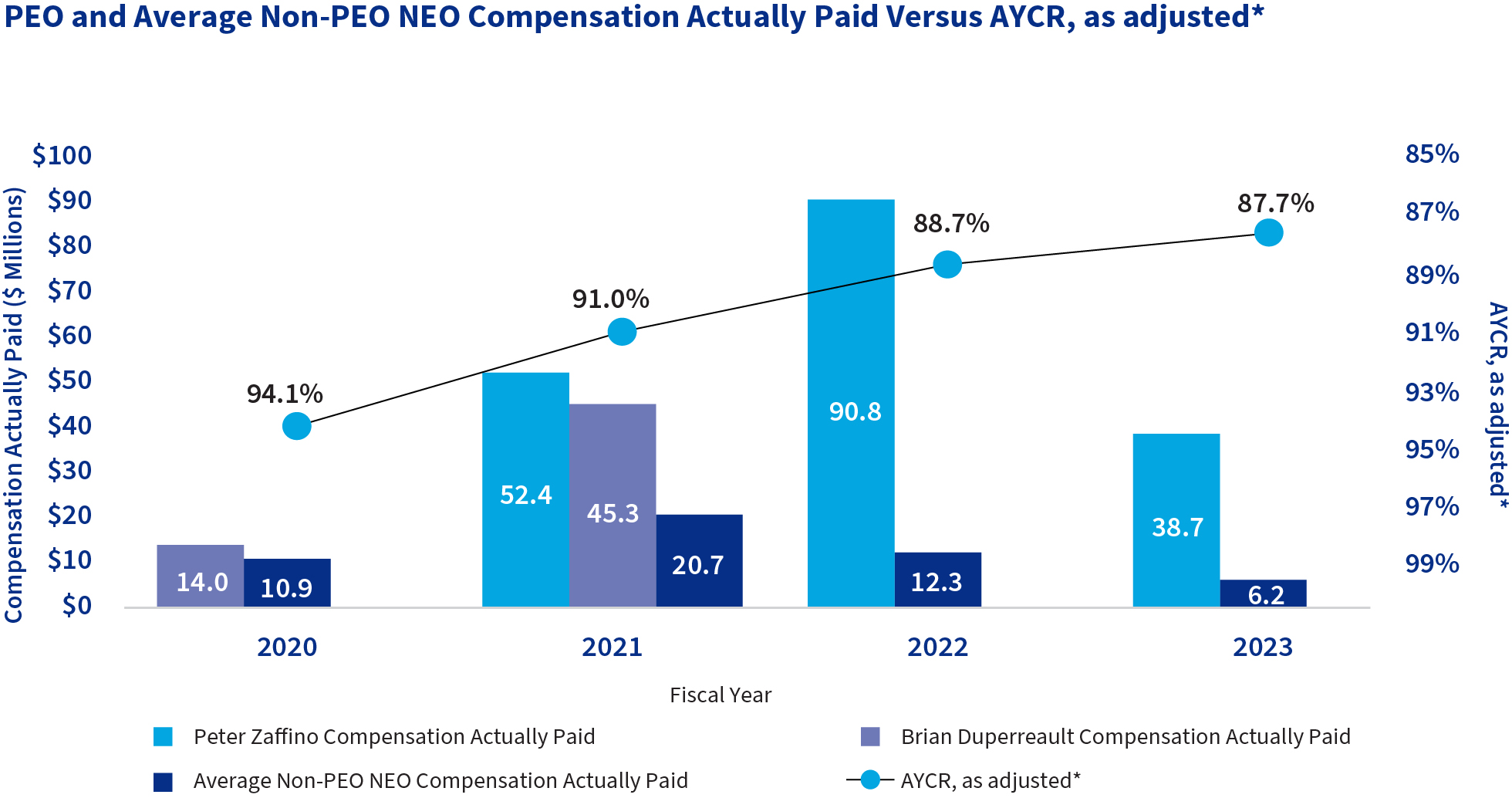

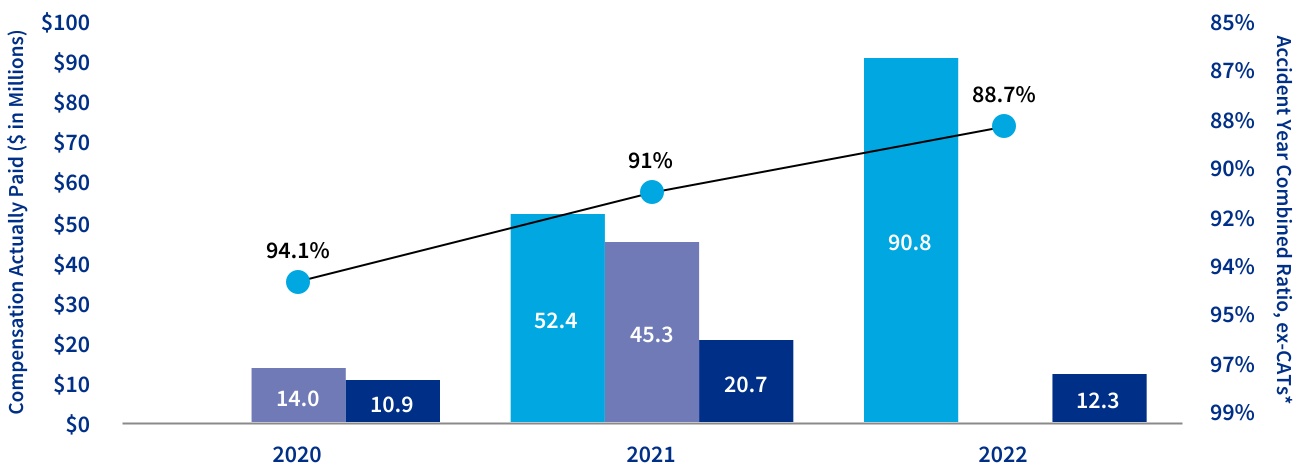

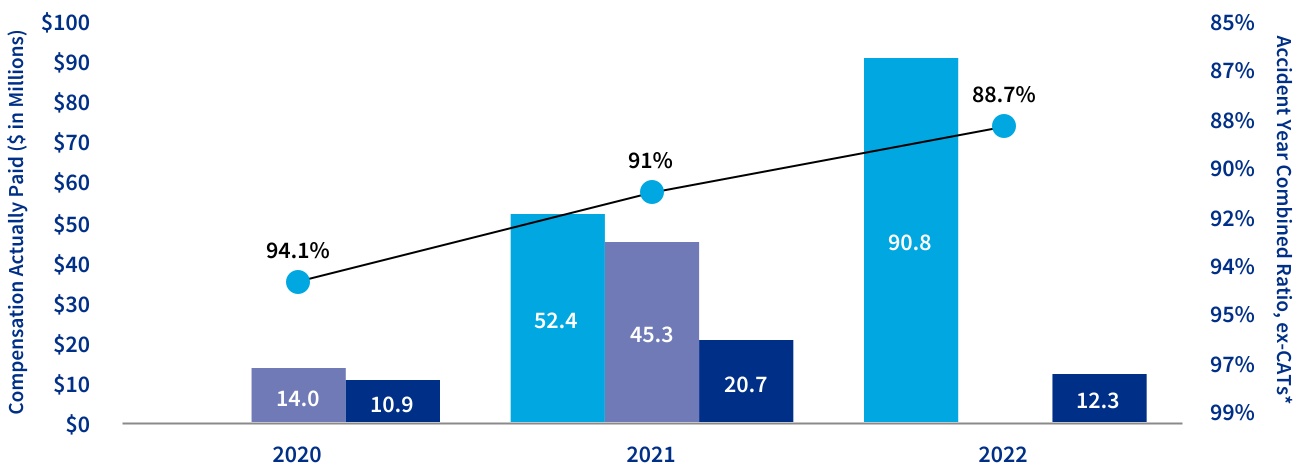

Strong Performance Resulting from Significant Improvement in Underwriting Income nGeneral Insurance achieved $2.3 billion in underwriting income, up 15 percent year over year n2023 combined ratio of 90.6 compared to 91.9 in 2022, and sub-100 in every quarter of 2023 n2023 accident year combined ratio, as adjusted* of 87.7 improved 1.0 point compared to 88.7 in 2022 | Continued Progress Towards Deconsolidation and Separation of Corebridge Financial, Inc. (Corebridge) nWe sold 159.75 million shares of Corebridge common stock in secondary public offerings with gross proceeds of $2.9 billion nCorebridge repurchased 17.2 million shares of its common stock from AIG for an aggregate purchase price of $315 million nCorebridge distributed dividends on Corebridge common stock totaling $1.1 billion to AIG nOur ownership of Corebridge reduced to 52.2 percent as of December 31, 2023 nCorebridge closed the sale of Laya Healthcare Limited for €691 million ($731 million) and announced the sale of AIG Life Limited for consideration of £460 million |

| |

*Accident year combined ratio, as adjusted is a non-GAAP financial measure. See Appendix A for a reconciliation showing how this metric is calculated from our audited financial statements.

AIG 2024 PROXY STATEMENT7

Proxy Statement Summary Executive Compensation Highlights

Executive Compensation Highlights

The Compensation and Management Resources Committee (CMRC) oversees our compensation programs, which are designed to reward performance against our strategic priorities and align executive pay with performance.

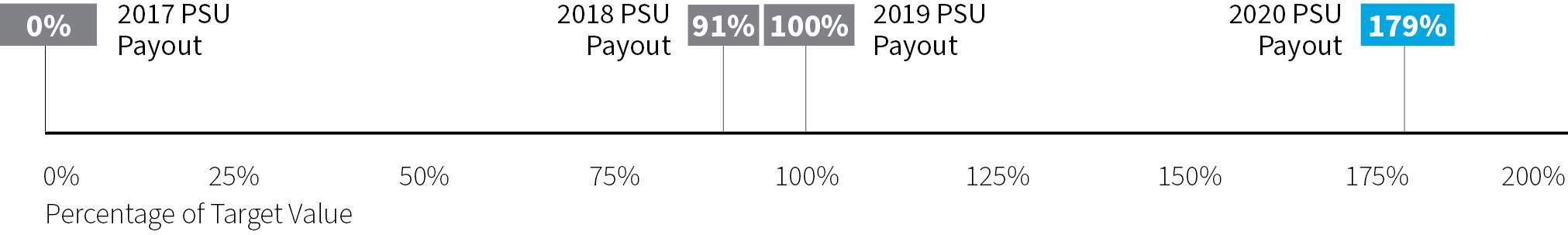

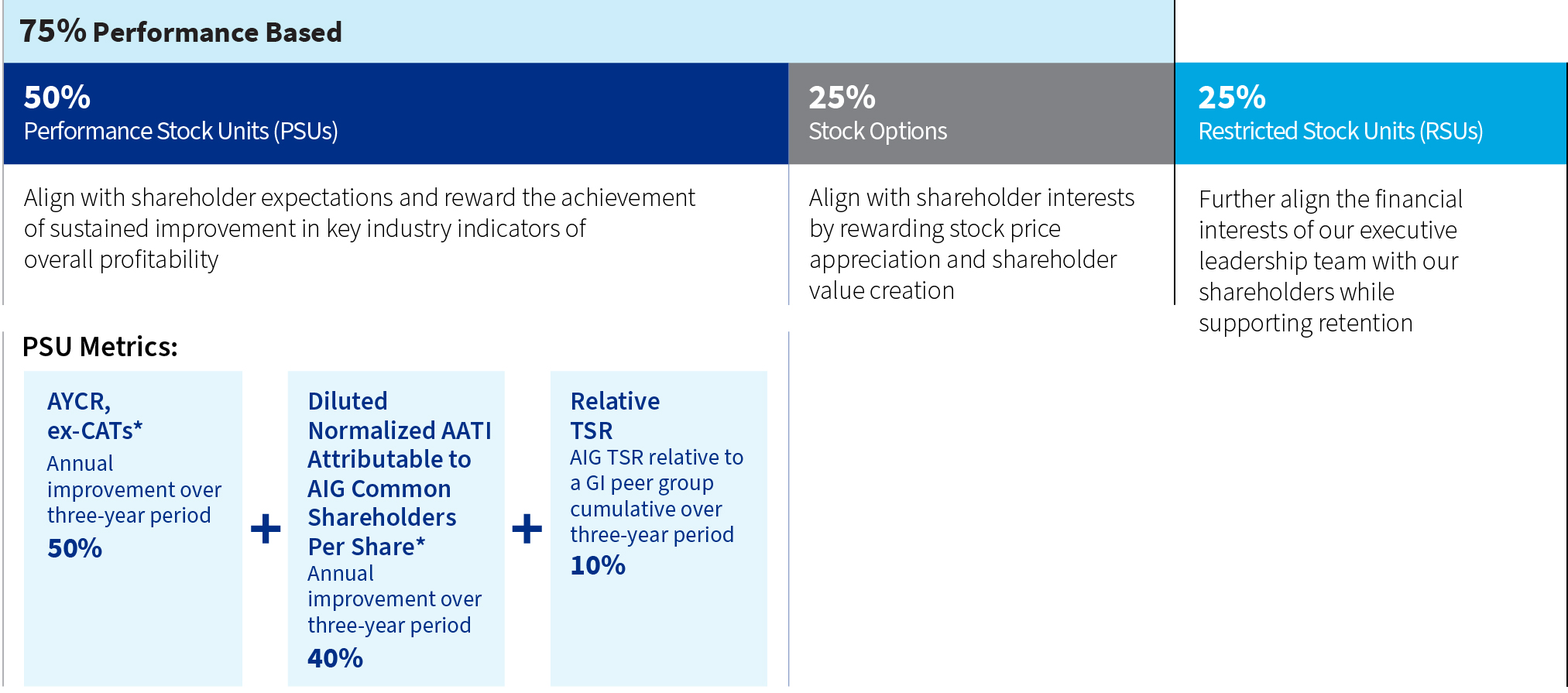

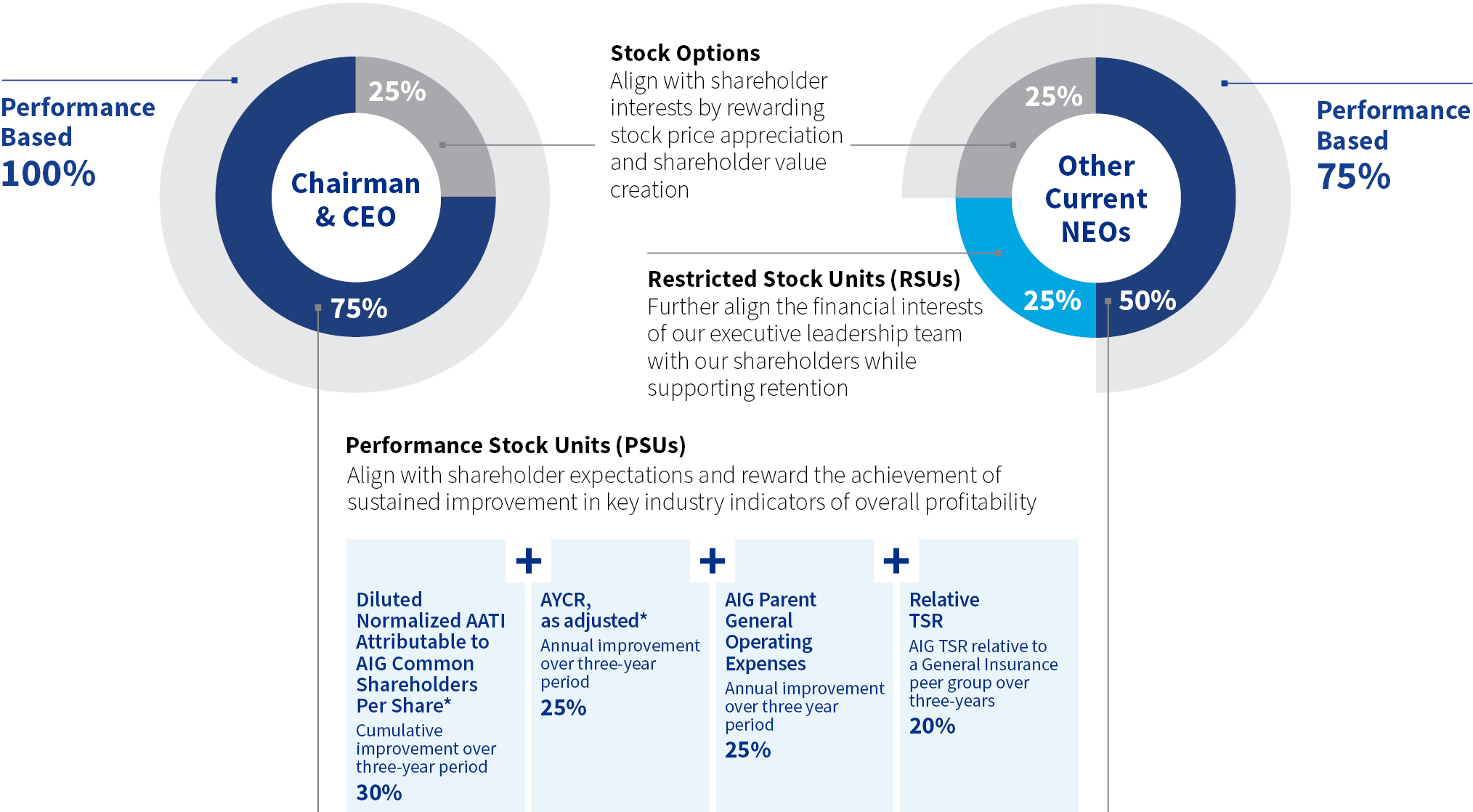

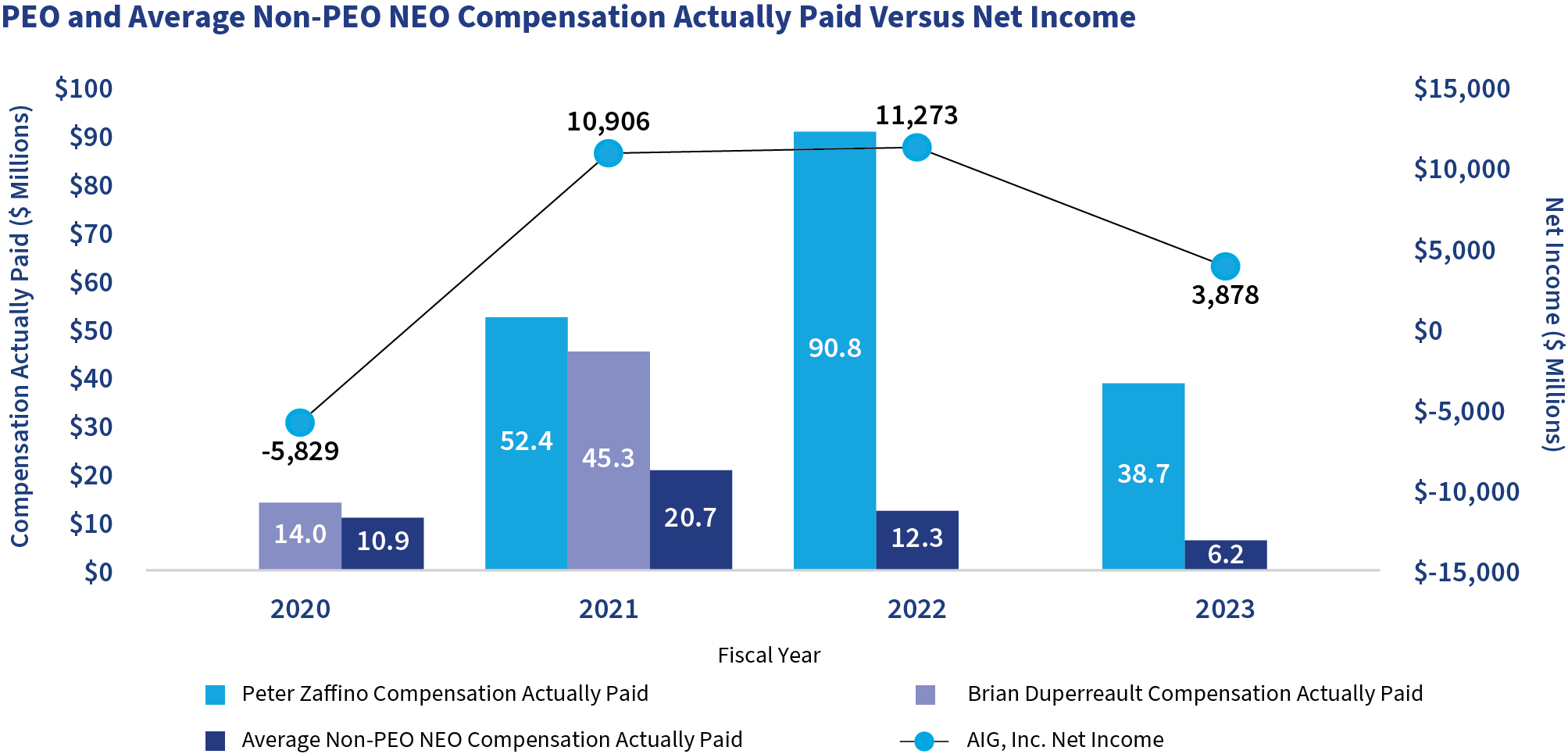

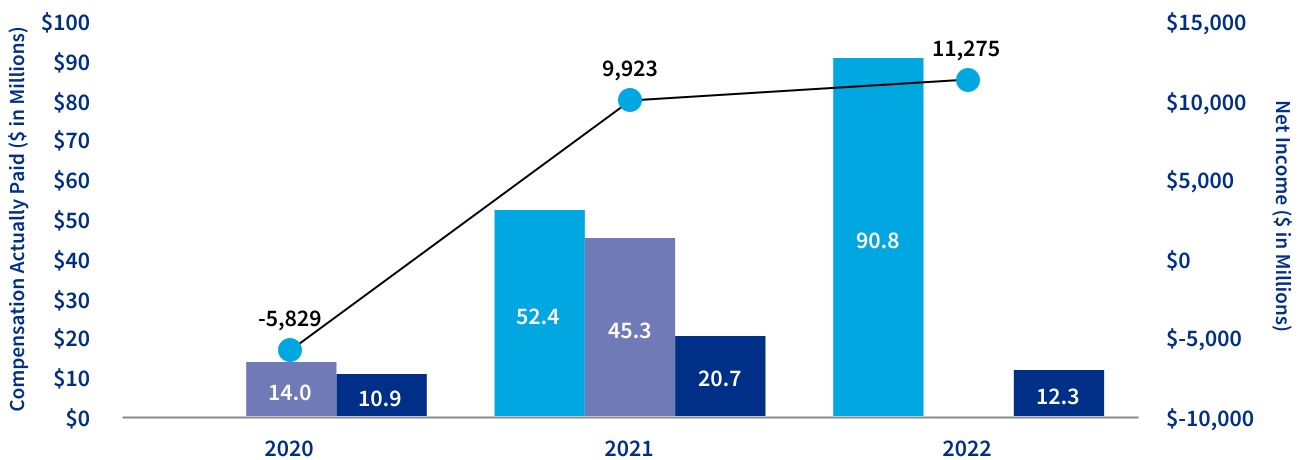

Our 2023 short-term incentive and long-term incentive program metrics reflected key areas of focus for our Company for relevant periods, including driving underwriting and operational excellence to improve profitability and setting the stage for transformative transactions.

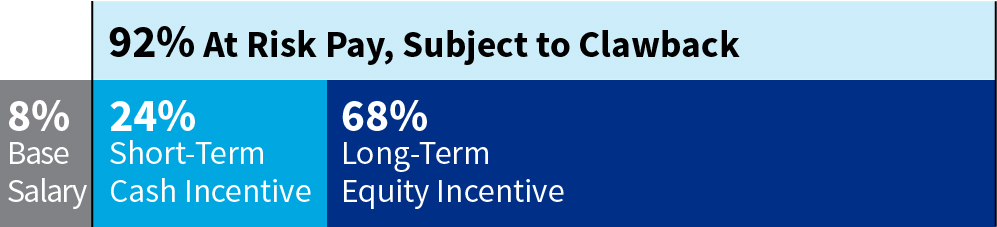

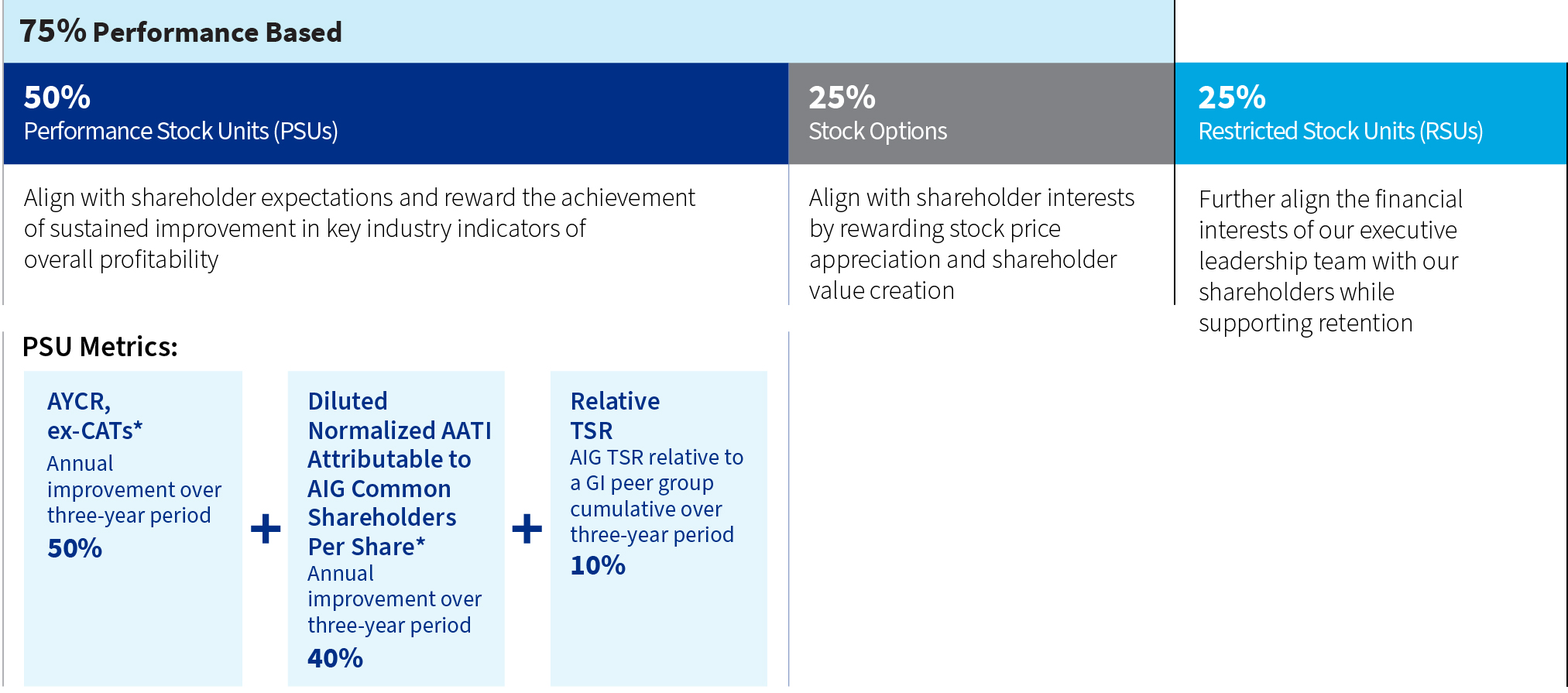

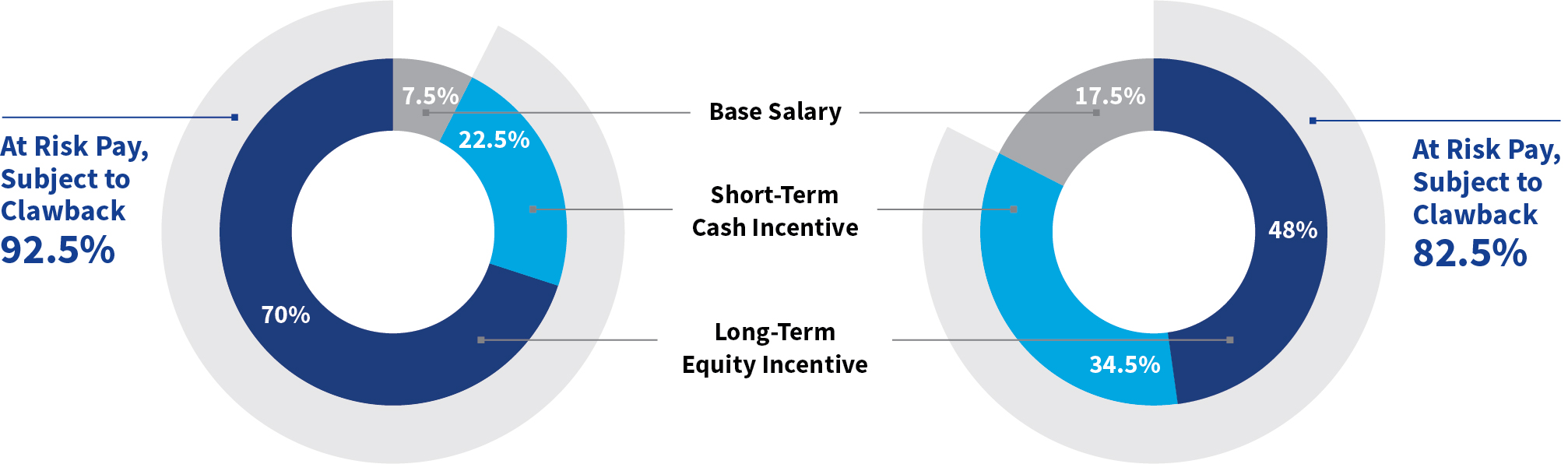

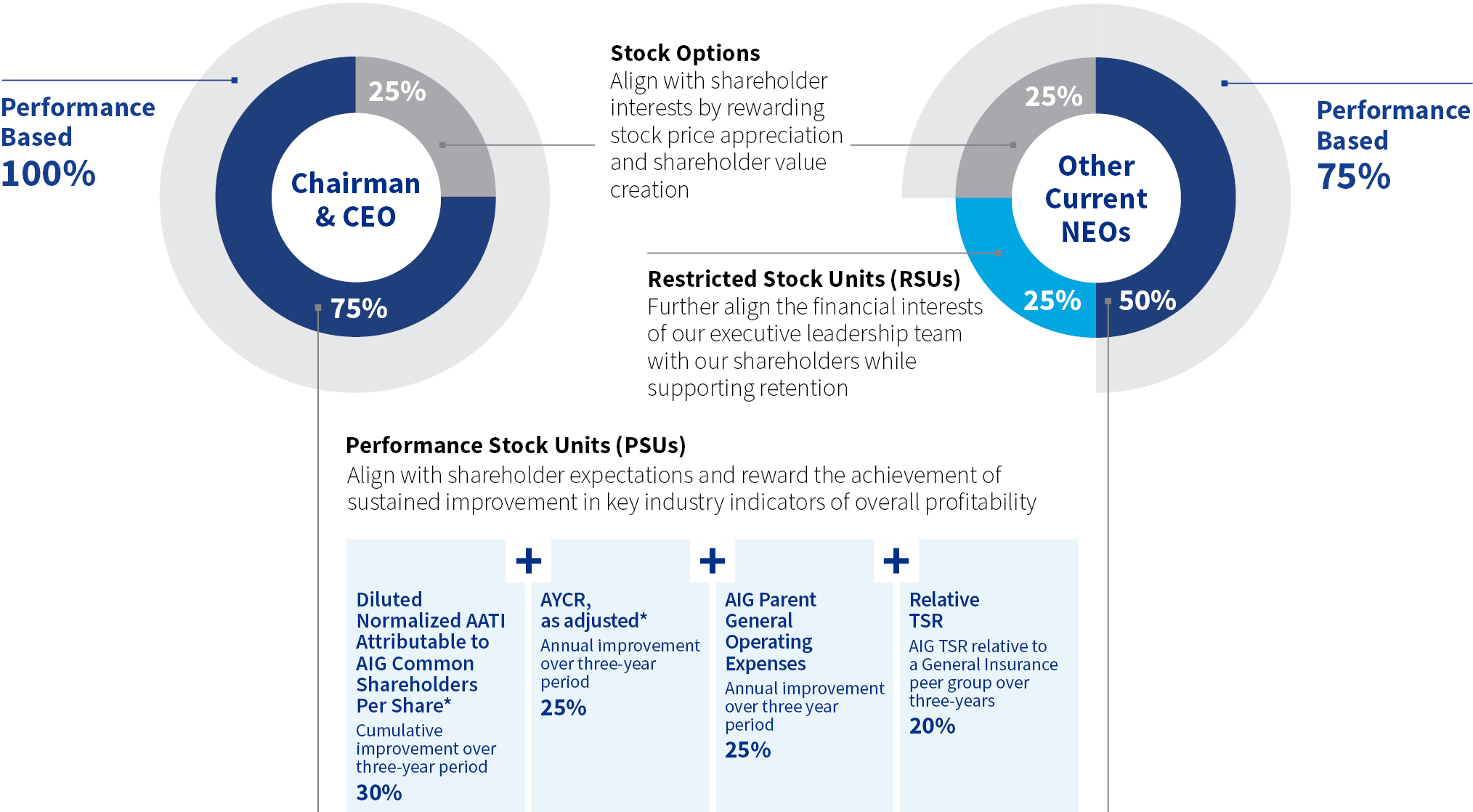

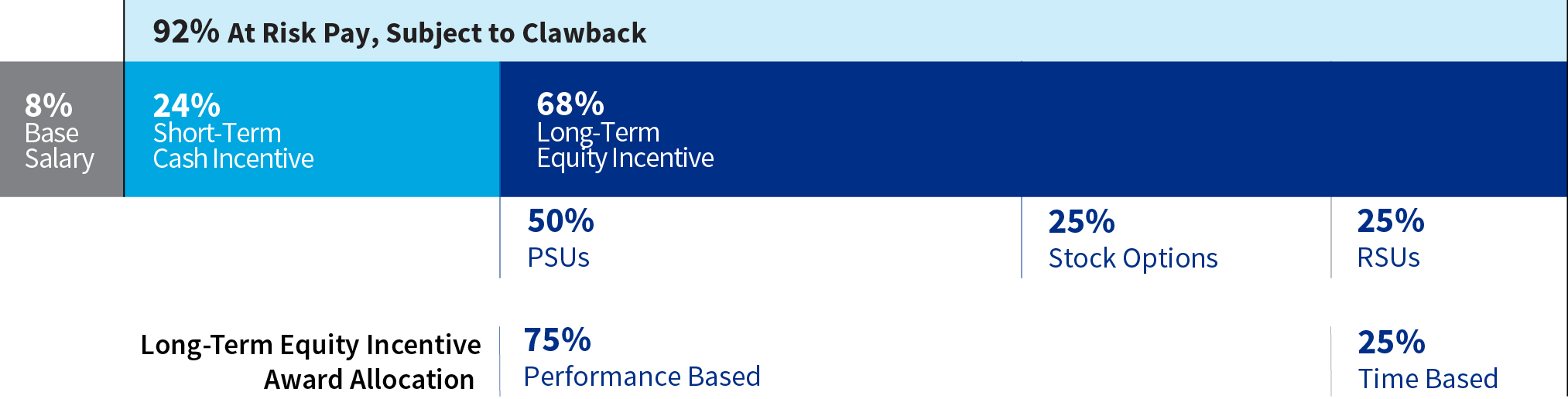

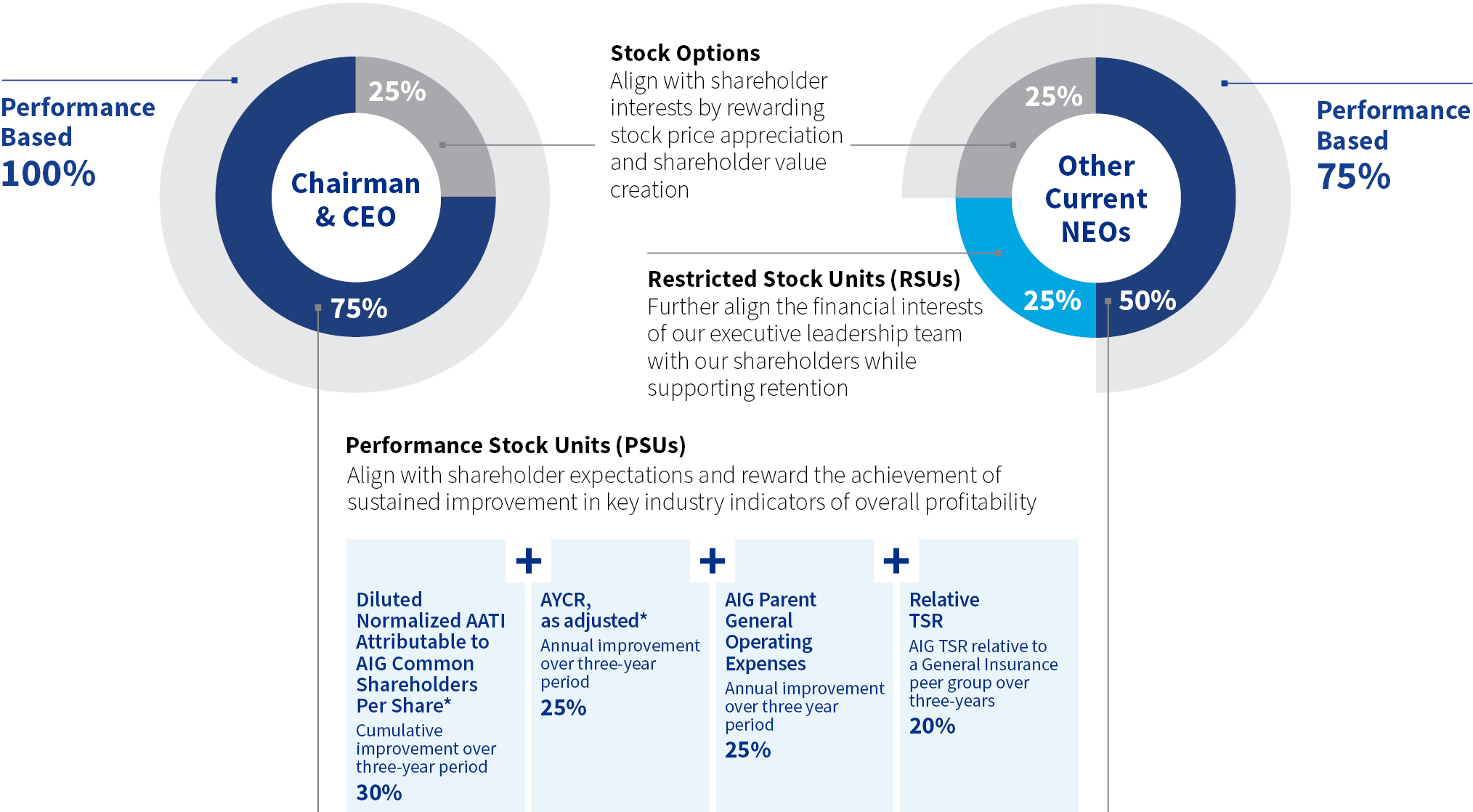

1.CEO incentive-based compensation for 2023 is 100 percent performance based in the form of Performance Share Units (PSUs) and stock options

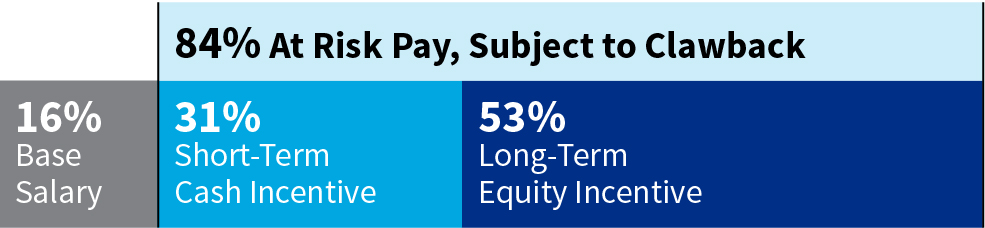

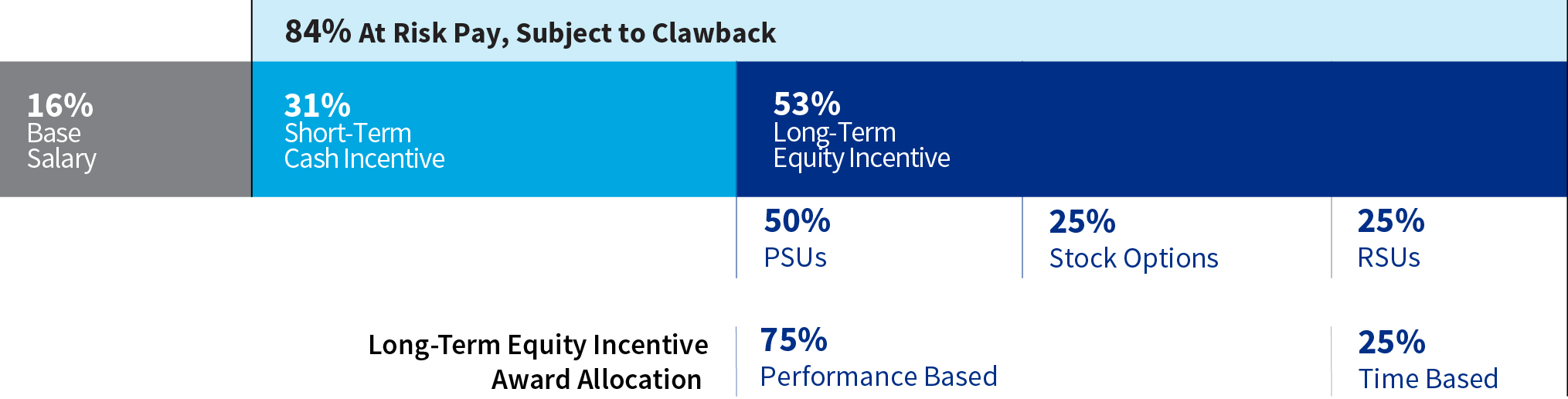

2.Majority of our named executives’ 2023 compensation is variable and at-risk

3.Majority of non-CEO named executives' 2023 long-term incentive compensation is performance-based in the form of PSUs and stock options

Our 2023 compensation programs, including the compensation decisions for each of the named executives, are detailed under “Compensation Discussion and Analysis” on page 39. Corporate Governance Highlights

Balanced and Independent Board of Directors

We strive to maintain a balanced and independent Board that is committed to representing the long-term interests of our shareholders. We seek to have a Board that possesses the substantial and diverse skills, experience and attributes necessary to provide guidance on our strategy and oversee management’s approach to addressing the challenges and risks facing the Company. The following table provides summary information about each of our ten director nominees. The Board recommends that our shareholders elect all ten director nominees listed below during the Annual Meeting. Each nominee is elected annually by a majority of votes cast.

Under our By-Laws, directors in an uncontested election must receive more votes “for” their election than “against.” Under the Corporate Governance Guidelines, each nominee has submitted an irrevocable resignation that becomes effective upon (1) the nominee’s failure to receive the required vote and (2) the Board's acceptance of the resignation. The Board will accept that resignation unless the NCGC recommends, and the Board determines, that the best interests of the Company and its shareholders would not be served by doing so.

All directors are independent, except for Mr. Zaffino.

8AIG 2024 PROXY STATEMENT

Proxy Statement Summary Corporate Governance Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Director

Since | | Current Committee Memberships* |

| Director Nominee | Age | Occupation and Background | Audit | CMR | NCG | Risk |

| | | | | | | | |

| | | | | | | | |

| Paola Bergamaschi | 62 | 2022 | Former Global Banking and Capital Markets Executive at State Street Corporation, Credit Suisse and Goldman Sachs | M | | | M |

| | | | | | | | |

| | | | | | | | |

| James Cole, Jr. | 55 | 2021 | Chairman & Chief Executive Officer of The Jasco Group, LLC; Former Delegated Deputy Secretary of Education and General Counsel of the U.S. Department of Education | | | C | M |

| | | | | | | | |

| | | | | | | | |

| James (Jimmy) Dunne III | 67 | 2023 | Vice Chairman and Senior Managing Principal, Piper Sandler | | | | |

| | | | | | | | |

| | | | | | | | |

| John (Chris) Inglis | 69 | 2024 | Strategic Advisor at Paladin Capital Group; Former National Cyber Director | | | | |

| | | | | | | | |

| | | | | | | | |

| Linda A. Mills | 74 | 2015 | Former Corporate Vice President of Operations, Northrop Grumman Corporation | | C | | M |

| | | | | | | | |

| | | | | | | | |

| Diana M. Murphy | 67 | 2023 | Managing Director, Rocksolid Holdings LLC |

| M | M | |

| | | | | | | | |

| | | | | | | | |

| Peter R. Porrino | 67 | 2019 | Former Executive Vice President & Chief Financial Officer, XL Group Ltd | C | | | C |

| | | | | | | | |

| | | | | | | | |

| John G. Rice

Lead Independent Director | 67 | 2022 | Former Non-Executive Chairman, GE Gas Power; Former President & Chief Executive Officer, GE Global Growth Organization | | M | M | |

| | | | | | | | |

| | | | | | | | |

| Vanessa A. Wittman | 56 | 2023 | Former Chief Financial Officer, Glossier, Inc. | M | | | M |

| | | | | | | | |

| | | | | | | | |

| Peter Zaffino | 57 | 2020 | Chairman & Chief Executive Officer, AIG | | | | |

| | | | | | | | |

KEY TO COMMITTEES

CMR Compensation and Management Resources NCG Nominating and Corporate Governance

CChair MMember

*Mr. Dunne and Mr. Inglis joined the Board in December 2023 and March 2024, respectively. They have not yet received any committee assignments.

We believe our nominees’ diverse and complementary skills, experience and attributes promote a well-functioning, highly qualified Board. We have undertaken significant Board refreshment in recent years to ensure that the directors are positioned to provide strategic guidance and oversight as we continue to make meaningful progress on strategic priorities, such as the continued separation of Corebridge and the repositioning of our portfolio for sustainable, profitable growth.

AIG 2024 PROXY STATEMENT9

Proxy Statement Summary Corporate Governance Highlights

Nominee Highlights

Board Meetings and Attendance in 2023

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

95% Average attendance by directors at the Board meetings held during 2023 | | 10 Board meetings | | 22 Committee meetings | | 96% Average attendance by directors at committee meetings |

| | | | | | |

In conjunction with each regularly scheduled Board and committee meeting, the independent directors meet in sessions without management. These sessions are led by the Lead Independent Director and committee chairs following Board and committee meetings, respectively.

Under the Corporate Governance Guidelines, directors are expected to attend the Annual Meeting. Each of the directors who stood for election at the 2023 Annual Meeting participated in that meeting.

10AIG 2024 PROXY STATEMENT

Proxy Statement Summary Corporate Governance Highlights

Shareholder Engagement

During the spring and fall of 2023 as well as early 2024, we continued our efforts to engage consistently and productively with our shareholders. Our Lead Independent Director and CMRC Chair participated in some of these engagement meetings, joined by our General Counsel, Chief Human Resources and Diversity Officer, Corporate Secretary, Head of Executive Compensation, Head of Investor Relations and Chief Sustainability Officer, as appropriate.

By the Numbers: Engagement in 2023 and Early 2024

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Reached out to 33 top shareholders, representing of shares outstanding | | Held 31 meetings with shareholders, representing of shares outstanding | | Met with ISS and Glass Lewis during Fall Engagement | | Lead Independent Director and CMRC Chair participated in meetings with shareholders representing of shares outstanding |

| | | | | | | | | | | |

| Shareholders Provided Feedback on the Key Topics Below | |

| nChairman & CEO performance, expressing high regard nExecutive compensation, including one-time awards nLong-term incentive equity mix for CEO n2023 say-on-pay vote outcome nTalent succession planning nRecent corporate governance enhancements nBoard leadership structure | | |

AIG 2024 PROXY STATEMENT11

| | |

|

Proposal 1 Election of Directors |

|

| | |

|

What am I voting on? The Board of Directors (Board) is seeking your support for the election of the ten individuals nominated to serve on the Board until the 20242025 Annual Meeting or until a successor is duly qualified and elected. Our director nominees hold and have held senior positions as leaders of various large and complex global businesses. Our nominees have been chief executive officers and chief financial officers, insurance regulators, senior executives with financial services, insurance, media, private equity and industrial firms, and senior government officials.officials and a military officer. Through these roles, our nominees have developed expertise in such areas as insurance, financial services, international business operations, risk management, corporate governance, M&A, technology, cybersecurity and human capital management. With this blend of skills and experience, our nominees bring fresh perspectives and a seasoned and practical approach to Board deliberations and oversight. Each director nominee is independent, except for our Chairman & Chief Executive Officer (CEO), Mr. Zaffino. Detailed biographical information for each director nominee follows. We have included the importantkey experiences, qualifications and skills, including other public company directorships, that our nominees bring to the Board. Each director nominee is currently a director on the Board and has consented to being named as a nominee in the proxy materials and to serve if elected. Voting Recommendation  The Board of Directors unanimously recommends a vote FOR each of the nominees for election to the Board at the 20232024 Annual Meeting. |

|

Board Composition and Refreshment Process

AIG prioritizesWe prioritize effective and aligned Board composition, supplemented by a thoughtful approach to refreshment. Over the past several years, the Board, with significant support from the Nominating and Corporate Governance Committee (the Committee or NCGC)(NCGC), has undertaken a thorough evaluation of the size and composition of the Board takingand its committees, resulting in a diverse Board with near gender parity. The Board and the NCGC take into account the characteristics and qualifications of existing directors, potential director departures and the Company'sour evolving strategic objectives.objectives and business environment when evaluating Board composition.

The CommitteeNCGC identifies candidates in several ways: current and former directors and senior management may recommend suitable candidates; any shareholder may recommend a director candidate by writing to AIG’s Corporate Secretary (see page 95103 for contact information); and the CommitteeNCGC may engage third-party search firms to ensure that there is a large and diverse pool of suitable candidates. AIG 2023 PROXY STATEMENT12 5AIG 2024 PROXY STATEMENT

Proposal 1 – Election of Directors Board Composition and Refreshment Process

Criteria for Board Membership

The Board and the NCGC conduct a rigorous review, taking into consideration the criteria set forth in AIG'sour Corporate Governance Guidelines. The Board considers the following attributes essential for all directors:

nHigh personal and professional ethics, values and integrity

nThe ability to work together as part of an effective, collegial group

nA commitment to representing the long-term interests of AIGthe Company and our shareholders

nThe skill,skills, expertise, background and experience with businesses and other organizations that the Board deems relevant

nThe interplay of the individual’scandidate’s experience with the experience of other Board members

nDiversity, including diversity of personal background and professional experience, skills and qualifications as well as race, gender, ethnicity, religion, nationality, disability, sexual orientation and cultural background

nThe contribution represented byof the individual’scandidate’s skills experience and attributesexperience to ensuring that the Board has the necessary tools to perform its oversight function effectively

nThe ability and willingness to commit adequatedevote the time necessary to AIG over an extended period of timefulfill a director's duties

Key Skills, Experience and Expertise

The CommitteeNCGC regularly reviews with the Board the essential skills, experience and expertise that are most important in selecting candidates to serve as directors, considering AIG’sour complex businesses, regulatory environment and the mix of capabilities and experience already represented on the Board. To this end, the Board and the NCGC have identified the following key skills and areas of expertise as essential for effective oversight in light of AIG’sour businesses and strategy:

| | | | | |

| Insurance Experience working in the insurance industry, particularly property and casualty |

| |

| Financial Services Experience in the non-insurance financial services industry, including banking and financial markets |

| |

| Business Transformation Experience leading or overseeing successful long-term business transformations and corporate restructurings at scale or significant acquisitions and integrations |

| |

| Public Company Executive Leadership Experience in a significant leadership position at a public company, such as a chief executive officer, chief financial officer or other senior leadership role |

| |

| Risk Management Experience with the identification, assessment and oversight of enterprise risk management programs and best practices, including those relating to operational risks and cyber risks |

| | | | | |

| Regulatory/Government Experience working in highly regulated industries and/or as a regulator or other government official |

| |

| Financial Reporting/Accounting Experience with financial reporting, accounting or auditing processes and standards |

| |

| International Experience Experience managing or overseeing businesses outside the U.S. and/or working or living in countries outside the U.S. |

| |

| TechnologyTechnology/Cyber KnowledgeExperience with oversight, development and adoption of or experience with technology and management of related issues and risks, including information security, cybersecurity and data management

|

| |

| Digital Knowledge of or experience with digital transformations and digital workflows, as well as related issues and risks |

| |

| ESG/Sustainability Experience with environmental, sustainability and governance (ESG)-related issues |

|

|

Diversity

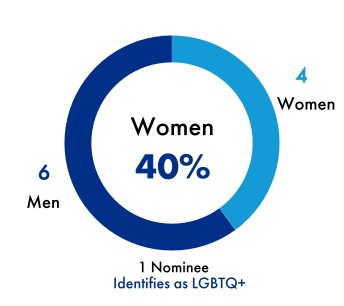

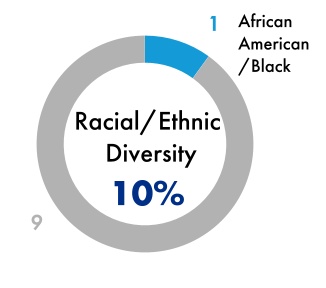

The Board strivesWe strive to maintain a diverse Board, and diversity continues to be an important consideration in the director search and nomination process.Board. While the Board has not adopted a specific policy on diversity, we believe that diversity — including with regard to race, gender, ethnicity, religion, nationality, disability, sexual orientation, veteran status and cultural background — is an important consideration in the director search and nomination process. Additionally, when considering theBoard composition of the Board and director refreshment, the Board and NCGC consider diversity in a broad sense, including work experience, skills and perspectives. The total mix of all these considerations contributes to more meaningful Board deliberations and oversight and it is critical to the Company’sour long-term success. Our director nominees include fivesix men and fivefour women, two nomineesone nominee who areis African American/Black, one nominee who is LGBTQ+ and one nominee who is LGBTQ+.a military veteran. Half of our four standing committees are chaired by a diverse director based on race or gender.

6AIG 2024 PROXY STATEMENT AIG 2023 PROXY STATEMENT13

Proposal 1 – Election of Directors Board Composition and Refreshment Process

AIG hasWe have undertaken significant Board refreshment in recent years. We believe our nominees’ diverse and complementary skills, experiences and attributes promote a well-functioning, highly-qualified Board to provide appropriate guidance and independent oversight. In the nominees’ biographies beginning on page 916 — as well as the summary graphic below — we highlight each nominee's key skills, experience and areas of expertise. | | | Skills, Experience and Expertise | | | | Skills, Experience and Expertise | | Diversity |

| | Director Nominee and Title | |

| | Director Nominee and Title | |

| | | | Skills, Experience and Expertise | | Diversity | | Gender (M/F) | LGBTQ+ |

| | Director nominee and title | Director Since | | | | | | | | | | | | | African

American/

Black | |

| | Gender (M/F) | LGBTQ+ |

| Paola Bergamaschi Former Global Banking and Capital Markets Executive at State Street Corporation, Credit Suisse and Goldman Sachs | |

| Paola Bergamaschi Former Global Banking and Capital Markets Executive at State Street Corporation, Credit Suisse and Goldman Sachs | |

| Paola Bergamaschi Former Global Banking and Capital Markets Executive at State Street Corporation, Credit Suisse and Goldman Sachs | Paola Bergamaschi Former Global Banking and Capital Markets Executive at State Street Corporation, Credit Suisse and Goldman Sachs | 2022

| ¢ | | ¢ | | ¢ | | | F | |

| | James Cole, Jr. Chairman & Chief Executive Officer of The Jasco Group, LLC; Former Delegated Deputy Secretary of Education and General Counsel of the U.S. Department of Education | James Cole, Jr. Chairman & Chief Executive Officer of The Jasco Group, LLC; Former Delegated Deputy Secretary of Education and General Counsel of the U.S. Department of Education | 2021 | ¢ | ¢ | | ¢ | | ¢ | | ¢ | | ¢ | | ¢ | M | ¢ |

| | W. Don Cornwell Former Chairman of the Board & Chief Executive Officer, Granite Broadcasting Corporation | 2011 | ¢ | | ¢ | | ¢ | | ¢ | M | |

James Cole, Jr. Chairman & Chief Executive Officer of The Jasco Group, LLC; Former Delegated Deputy Secretary of Education and General Counsel of the U.S. Department of Education | |

| James Cole, Jr. Chairman & Chief Executive Officer of The Jasco Group, LLC; Former Delegated Deputy Secretary of Education and General Counsel of the U.S. Department of Education | | 2021 | ¢ | ¢ | | | ¢ | | ¢ | | ¢ | M | ¢ |

| James (Jimmy) Dunne III Vice Chairman and Senior Managing Principal, Piper Sandler | |

| James (Jimmy) Dunne III Vice Chairman and Senior Managing Principal, Piper Sandler | |

| James (Jimmy) Dunne III Vice Chairman and Senior Managing Principal, Piper Sandler | |

| John (Chris) Inglis Strategic Advisor at Paladin Capital Group; Former National Cyber Director | |

| John (Chris) Inglis Strategic Advisor at Paladin Capital Group; Former National Cyber Director | |

| John (Chris) Inglis Strategic Advisor at Paladin Capital Group; Former National Cyber Director | |

| Linda A. Mills Former Corporate Vice President of Operations, Northrop Grumman Corporation | |

| Linda A. Mills Former Corporate Vice President of Operations, Northrop Grumman Corporation | |

| | Linda A. Mills Former Corporate Vice President of Operations, Northrop Grumman Corporation | Linda A. Mills Former Corporate Vice President of Operations, Northrop Grumman Corporation | 2015 | ¢ | | ¢ | | ¢ | | | F | |

| | Diana M. Murphy Managing Director, Rocksolid Holdings LLC | Diana M. Murphy Managing Director, Rocksolid Holdings LLC | 2023 | | ¢ | | ¢ | | ¢ | | | F | |

| | Diana M. Murphy Managing Director, Rocksolid Holdings LLC | |

| Diana M. Murphy Managing Director, Rocksolid Holdings LLC | |

| Peter R. Porrino Former Executive Vice President & Chief Financial Officer, XL Group Ltd | |

| Peter R. Porrino Former Executive Vice President & Chief Financial Officer, XL Group Ltd | |

| Peter R. Porrino Former Executive Vice President & Chief Financial Officer, XL Group Ltd | Peter R. Porrino Former Executive Vice President & Chief Financial Officer, XL Group Ltd | 2019 | ¢ | | ¢ | | | M | |

| | John G. Rice LEAD INDEPENDENT DIRECTOR Former Non-Executive Chairman, GE Gas Power; Former President & Chief Executive Officer, GE Global Growth Organization | John G. Rice LEAD INDEPENDENT DIRECTOR Former Non-Executive Chairman, GE Gas Power; Former President & Chief Executive Officer, GE Global Growth Organization | 2022 | ¢ | ¢ | | ¢ | | | M | |

| | Therese M. Vaughan Professional Director of the Emmett J. Vaughan Institute of Risk Management and Insurance at the University of Iowa; Former Chief Executive Officer of the National Association of Insurance Commissioners | 2019 | ¢ | | ¢ | | ¢ | | | F | |

John G. Rice LEAD INDEPENDENT DIRECTOR Former Non-Executive Chairman, GE Gas Power; Former President & Chief Executive Officer, GE Global Growth Organization | |

| John G. Rice LEAD INDEPENDENT DIRECTOR Former Non-Executive Chairman, GE Gas Power; Former President & Chief Executive Officer, GE Global Growth Organization | |

| Vanessa A. Wittman Former Chief Financial Officer, Glossier, Inc. | |

| Vanessa A. Wittman Former Chief Financial Officer, Glossier, Inc. | |

| | Vanessa A. Wittman Former Chief Financial Officer, Glossier, Inc. | Vanessa A. Wittman Former Chief Financial Officer, Glossier, Inc. | 2023 | | ¢ | | ¢ | | | F | |

| | Peter Zaffino Chairman & Chief Executive Officer, AIG | Peter Zaffino Chairman & Chief Executive Officer, AIG | 2020 | ¢ | ¢ | | | M | |

| | Peter Zaffino Chairman & Chief Executive Officer, AIG | |

| Peter Zaffino Chairman & Chief Executive Officer, AIG | |

| | Total Skills, Experience and Expertise and Diversity | Total Skills, Experience and Expertise and Diversity | | 8 | 5 | 7 | 9 | 6 | 4 | 7 | 4 | 5 | 4 | 5 | | 2 | 5M/5F | 1 |

| | Total Skills, Experience and Expertise and Diversity | |

| | Total Skills, Experience and Expertise and Diversity | | | 7 | 7 | 6 | 7 | 6 | 3 | 7 | 6 | 4 | 4 | | 1 | 6M/4F | 1 |

AIG 2023 PROXY STATEMENT14 7AIG 2024 PROXY STATEMENT

Proposal 1 – Election of Directors Director Nominees

Director Nominees

The Board, on the recommendation of the NCGC, has nominated for election to the Board the ten individuals presented in the Proxy Statement beginning on page 916. All are currentincumbent directors of AIG and were elected by the shareholders at the 20222023 Annual Meeting, other than Paola BergamaschiMr. Dunne, who joined the Board in December 2022,2023 and Diana M. Murphy and Vanessa A. Wittman,Mr. Inglis, who joined the Board in March 2023. Third-party search firms identified Ms. Bergamaschi and Ms. Murphy, and an2024. An executive officer identified Ms. Wittman.Mr. Dunne and a third-party executive recruitment firm that assisted with recruitment efforts identified Mr. Inglis. Both Mr. Dunne and Mr. Inglis were interviewed by our directors and were subject to the Board's customary due diligence and evaluation procedures. AIG’sOur Corporate Governance Guidelines and By-Laws do not impose term limits because, in certain circumstances, the Board believes that a director who serves for an extended period could be uniquely positioned to provide insight and perspective regarding AIG’sthe Company's operations and strategic direction. Our Corporate Governance Guidelines require that directors retire at the annual meeting after reaching age 75, unless, at the Committee’sNCGC’s recommendation, the Board waives this limitation for a period of one year if it is deemed to be in the best interests of AIG.the Company and its shareholders. The Board has elected to makemade such an exception for W. DonMr. Cornwell having concluded that the Company would benefit from Mr. Cornwell’s continued contributions toin 2023, whose service on the Board given his insight and historical perspective regarding AIG.will expire on the day of the 2024 Annual Meeting in accordance with the Corporate Governance Guidelines.

As previously disclosed, two of our current directors, DouglasTherese M. Steenland, who until December 31, 2022, had been the Board's Lead Independent Director, and William G. Jurgensen are not standing for election and will retire at the 2023 Annual Meeting. We thank Mr. Steenland, Mr. Jurgensen, and Thomas M. Motamed, whoVaughan retired from the Board in January 2023 for health reasons,2024. We thank Mr. Cornwell and Ms. Vaughan for their service and valuable contributions as directors.

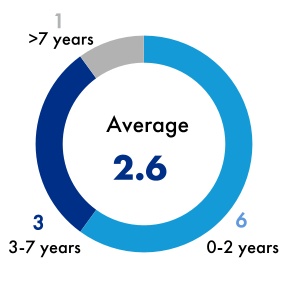

In light of the recent retirements and Board refreshment efforts, the average tenure of the director nominees is 3.32.6 years.

Director Independence

| | | | | |

All of AIG'sour non-management directors are independent under the New York Stock Exchange (NYSE) listing standards and AIG'sour independence standards, which are set forth in the Corporate Governance Guidelines.Guidelines available on our website (www.aig.com). To be considered independent, a director must have no disqualifying relationships, as defined by the NYSE, and the Board must affirmatively determine that he or she has no material relationships with AIG,the Company, either directly or as a partner, shareholder or officer of another organization that has a relationship with AIG.the Company. | |

| All director nominees are independent except for the Chairman & Chief Executive Officer |

|

Before joining the Board, and annually thereafter, each director or nominee (as applicable) completes a questionnaire seeking information about relationships and transactions that may require disclosure, that may affect the director's independence determination for that individual, or that may affect the heightened independence standards that apply to members of the CMRC and Audit and Compensation and Management Resources committees.Committee.

The NCGC's assessment of independence considers all known relevant facts and circumstances about the relationships bearing on the independence of a director or nominee. This assessment also considers sales of Company insurance products and services, in the ordinary course of business and on the same terms made available to third parties, between AIG (including its subsidiaries) and otherto companies or charitable organizations where a director (or immediate family members) may have relationships pertinent to the independence determination. The NCGC also considers fees paid to companies where directors are employed or affiliated that are less than 1% of such companies' total revenues. The NCGC reviews these relationships to assess their materiality and determinedetermines if any such relationship would impair the independence and judgment of the relevant director.

The Board, on the recommendation of the NCGC, has determined that, each director nominee other than Mr. Zaffino each nominee for election at the 2023 Annual Meeting — Paola Bergamaschi, James Cole, Jr., W. Don Cornwell, Linda A. Mills, Diana M. Murphy, Peter R. Porrino, John G. Rice, Therese M. Vaughan and Vanessa A. Wittman — does not have directlya direct or indirectly, aindirect material relationship with AIG,the Company, or any direct or indirect material interest in any transactions involving AIGthe Company and, therefore, satisfies the independence criteria in the NYSE's listing standards and our Corporate Governance Guidelines. Mr. Zaffino, as CEO, is the only director nominee who holds a management position and is not an independent director under the NYSE's listing standards.

Mr. Steenland, who is not standing for re-election to the Board, was also determined by the Board, on the recommendation of the NCGC, to be independent under the NYSE listing standards and our Corporate Governance Guidelines during 2022. In making this determination, the NCGC considered Mr. Steenland's relationship with Blackstone Inc. (Blackstone), where he serves as a senior advisor. While Blackstone has a 9.9 percent equity stake in Corebridge and has entered into certain other transactions with AIG, the Board noted that Mr. Steenland is an advisor to Blackstone, not an employee, and he recused himself from the discussions and approvals associated with those transactions.

8AIG 2023 PROXY STATEMENT

Proposal 1 – Election of Directors Director Nominees

Mr. Motamed, who retired from the Board in January 2023, and Mr. Jurgensen,Cornwell, who will not stand for re-election at the 20232024 Annual Meeting, and Ms. Vaughan, who retired from the Board in January 2024, were each also determined by the Board, on the recommendation of the NCGC, to be independent under the NYSE listing standards and our Corporate Governance Guidelines during 2022.2023.

With regard to the former directors who did not stand for re-election at the 20222023 Annual Meeting — namely, John H. Fitzpatrick, Christopher S. LynchDouglas Steenland, William Jurgensen and Amy L. SchioldagerThomas Motamed — the Board, on the recommendation of the NCGC, determined that they were independent under the NYSE listing standards for the period during which they served on the Board in 2022.2023.

AIG 2024 PROXY STATEMENT15

Proposal 1 – Election of Directors Director Nominees

Director Nominee Biographies

AIG strivesWe strive to maintain a balanced and independent Board that is committed to representing the long-term interests of AIG’sour shareholders. We seek to have a Board that possesses the diverse skills, experience and attributes necessary to provide guidance on AIG’sour strategy and to oversee management’s approach to addressing the challenges and risks facing AIG.the Company.

The following table provides summary information about each of our ten director nominees. The Board recommends that our shareholders elect all ten director nominees listed below at the Annual Meeting. Each nominee is elected annually by a majority of votes cast in uncontested elections.

| | | | | |

| CAREER HIGHLIGHTS nState Street Corporation (financial services company) —Senior Managing Director, Head of EMEA Asset Owners Sector Solutions, 2013 to 2014 —Senior Managing Director, Head of Client Relationship Management, Global Markets, 2011 to 2013 —Senior Managing Director, Global Head of Equity Distribution, 2008 to 2010 —Various positions, 2003 to 2008 nCredit Suisse First Boston —Director, Equity Sales, 1998 to 2003 nSanpaolo IMI S.p.A —Director, Head of Equities, 1995 to 1998 nGoldman Sachs —Executive Director, Equity Research, 1989 to 1995 OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS nNone OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT nBoard Advisor, Quantexa since 2021 nDirector, Bank of New York Mellon International Limited, since 2017 nDirector, Wells Fargo Securities International Limited, 2017 to 2023 nDirector, ARCA Fondi SGR, since 2015 |

¢ Independent Age: 6162

Director since: 2022 COMMITTEES Ms. Bergamaschi will receive her committee appointments after the 2023 Annual MeetingnAudit (Financial Expert)

nRisk |

| |

Key Experience and Qualifications: In light of Ms. Bergamaschi’s experience as a financial services executive with deep international expertise in capital markets, global banking, financial reporting and risk and international regulatory oversight, the Board has concluded that Ms. Bergamaschi should be elected.re-elected. |

AIG 2023 PROXY STATEMENT16 9AIG 2024 PROXY STATEMENT

Proposal 1 – Election of Directors Director Nominees

| | | | | |

| CAREER HIGHLIGHTS nThe Jasco Group, LLC (investment management firm) —Chairman & Chief Executive Officer, since 2017 nU.S. Department of Education —Delegated Deputy Secretary of Education & General Counsel, 2016 to 2017 —General Counsel, 2014 to 2017 —Senior Advisor to the Secretary, 2014 nU.S. Department of Transportation —Deputy General Counsel, 2011 to 2014 nWachtell, Lipton, Rosen & Katz —Partner, 2004 to 2011 —Associate, 1996 to 20112004 OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS nNone OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT nNational Board of Directors, Jumpstart for Young Children, since 2017 nSenior Advisor, National Student Legal Defense Network, since 2021 nDirector, Entrepreneurs of Tomorrow, 2021 to 2023 nTrustee, Prep for Prep, 2005 to 2011 nDirector, NAACP Legal Defense and Educational Fund, 2004 to 2011 |

¢ Independent Age: 5455

Director since: 2021 COMMITTEES nNominating and Corporate Governance (Chair) nRisk and Capital |

| |

Key Experience and Qualifications: In light of Mr. Cole’s considerable public policy and government experience, as well as his professional experience as a corporate lawyer advising multinational corporations on their strategic transactions and corporate governance matters, the Board has concluded that Mr. Cole should be re-elected. |

| | |

| | James (Jimmy) Dunne III |

| W. Don Cornwell |

| |

| | | | | |

| CAREER HIGHLIGHTS nGranite Broadcasting Corporation (television broadcasting) —Founder, Chairman of the Board & Chief Executive Officer, 1988 to 2009Piper Sandler Co. (investment bank)

—Vice Chairman 2009and Senior Managing Principal, since 2020 nGoldman SachsSandler O'Neill & Partners, L.P. —Chief Operating Officer, Corporate Finance Department, 1980Founding Partner, 1988 to 1988 —Vice President, Investment Banking Division, 1976 to 19882020

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS nNatura &Co Holding S.A.,None OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT nDirector, PGA Tour Board, since 20202023 nViatrisDirector, Chime Financial, Inc. (Pfizer spinoff that merged with Mylan), since 2020 FORMER PUBLIC COMPANY DIRECTORSHIPS

nPfizer Inc., 1997 to 20202022

nAvon Products, Inc., 2002 to 2020Trustee, University of Notre Dame, since 2010 |

¢ Independent Age: 7567

Director since: 2011 COMMITTEES2023

nAudit (Financial Expert)

nNominating and Corporate Governance

|

| |

Key Experience and QualificationsQualifications:: In light of Mr. Cornwell’sDunne’s expertise in investment banking, management and financial sector services and three decades of experience in significant financial and strategic business transformations, as well as his professional experience across the financial services industry, the Board has concluded that Mr. CornwellDunne should be re-elected.elected. |

10AIG 2024 PROXY STATEMENT AIG 2023 PROXY STATEMENT17

Proposal 1 – Election of Directors Director Nominees

| | |

| | John (Chris) Inglis |

| Linda A. Mills |

| |

| | | | | |

| CAREER HIGHLIGHTS nCadorePaladin Capital Group LLC (management and IT consulting)(cyber venture capital investment firm) —President, 2015 to presentSenior Strategic Advisor, since 2023 nNorthrop Grumman CorporationU.S. National Cyber Director, 2021 to 2023 nCommissioner, U.S. Cyberspace Solarium Commission, 2019 to 2020 nNational Security Agency —Corporate Vice President, Operations, 2013 to 2015 —Corporate Vice President & President of Information SystemsDeputy Director and Information Technology sectors, 2008 to 2012

—President of the Civilian Agencies Group,Chief Operating Officer, 2006 to 2007

—Vice President of Operations and Process, Information Technology Sector, 2003 to 2006

nTRW, Inc.

—Various positions, 1979 to 2002, including Vice President of Information Systems and Processes2014

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS nNavient Corporation (non-executive chair)Huntington Bancshares Inc., since 2014 |

¢Independent

Age: 73

Director since: 2015

COMMITTEES

nCompensation and Management Resources (Chair)

nAudit

|

| |

Key Experience and Qualifications: In light of Ms. Mills’ experience with large and complex international operations, risk management, information technology and cybersecurity, and her prior management of a significant line of business, the Board has concluded that Ms. Mills should be re-elected.

|

| | | | | |

| CAREER HIGHLIGHTS

nRocksolid Holdings, LLC (private equity)

—Managing Director, 2007 to present

nUnited States Golf Association

—President, 2016 to 20182021 and since 2023

nGeorgia Research Alliance Venture Fund

—Managing Director, 2012 to 2016

nChartwell Capital Management Co., Inc.

—Managing Director, 1997 to 2007

nTribune Media Company, 1979 to 1995

—Senior Vice President, Advertising and Marketing, The Baltimore Sun Company, 1992 to 1995

—Various positions, 1979 to 1992

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS

nSynovus Financial Corp., since 2017

nLandstar System, Inc. (non-executive chair), since 1998

FORMER PUBLIC COMPANY DIRECTORSHIPS

nCTS Corporation, 2010 to 2020

|

¢Independent

Age: 66

Director since: 2023

COMMITTEES

Ms. Murphy will receive her committee appointments after the 2023 Annual Meeting

|

| |

Key Experience and Qualifications: In light of Ms. Murphy’s significant business acumen, including her experience in leading complex companies through strategic and organizational change, her experience as a seasoned public company director, as well as her background in media, communications and marketing, the Board has concluded that Ms. Murphy should be elected.

|

AIG 2023 PROXY STATEMENT11

Proposal 1 – Election of Directors Director Nominees

| | | | | |

| CAREER HIGHLIGHTS

n XL Group Ltd (insurance and reinsurance)

—Senior Advisor to the Chief Executive Officer, 2017 to 2018

—Executive Vice President & Chief Financial Officer, 2011 to 2017

nErnst & Young LLP

—Global Insurance Industry Leader, 1999 through 2011

nConsolidated International Group

—President & Chief Executive Officer, 1998 to 1999

nZurich Insurance Group

—Chief Financial Officer & Chief Operating Officer of Zurich Re Centre, 1993 to 1998

nErnst & Young LLP

—Auditor, 1978 to 1993

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS

nNone

|

¢Independent

Age: 66

Director since: 2019

COMMITTEES

nAudit (Chair)

nRisk and Capital

|

| |

Key Experience and Qualifications: In light of Mr. Porrino’s professional experience related to the global insurance industry, as well as his experience in finance, accounting and risk management, the Board has concluded that Mr. Porrino should be re-elected.

|

| | | | | |

| CAREER HIGHLIGHTS

nGeneral Electric Company (multinational conglomerate)

—Non-Executive Chairman, GE Gas Power, 2018 to 2020

—Vice Chairman, GE, 2005 to 2018

—President & Chief Executive Officer, GE Global Growth Organization, 2010 to 2017

—Various other senior positions, including:

•President & Chief Executive Officer, GE Technology Infrastructure, 2005 to 2010

•President & Chief Executive Officer, GE Industrial, 2005

•Senior Vice President, GE Energy, 2004

•Senior Vice President, GE Power Systems, 2000 to 2003

• Vice President GE Transportation Systems, 1997 to 1999

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS

nBaker Hughes Company, since 2017

|

¢Lead Independent Director

Age: 66

Director since: 2022

COMMITTEES

nNominating and Corporate Governance (Chair)

nAudit (Financial Expert)

|

| |

Key Experience and Qualifications: In light of Mr. Rice’s leadership experience, including leading complex, global organizations, the Board has concluded that Mr. Rice should be re-elected.

|

12AIG 2023 PROXY STATEMENT

Proposal 1 – Election of Directors Director Nominees

| | | | | |

| CAREER HIGHLIGHTS

nUniversity of Iowa (higher education)

—Professional Director of the Emmett J. Vaughan Institute of Risk Management and Insurance, since 2021

nDrake University (higher education)

—Executive in Residence, 2019 to 2021

—Robb B. Kelley Visiting Distinguished Professor of Insurance and Actuarial Science, 2017 to 2019

—Dean of the College of Business and Public Administration, 2014 to 2017

nNational Association of Insurance Commissioners (NAIC)

—Chief Executive Officer, 2009 to 2012

nJoint Forum (group of banking, insurance, and securities supervisors)

—Chair, 2012

nState of Iowa

—Insurance Commissioner, 1994 to 2004

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS

nVerisk Analytics, Inc., since 2013

nWest Bancorporation, Inc., since 2019

FORMER PUBLIC COMPANY DIRECTORSHIPS

nValidus Holdings, Ltd., 2013 to 2018

|

¢Independent

Age: 66

Director since: 2019

COMMITTEES

nCompensation and Management Resources

nRisk and Capital

|

| |

Key Experiences and Qualifications: In light of Ms. Vaughan’s considerable experience in the insurance industry as well as her professional experience in insurance regulation, the Board has concluded that Ms. Vaughan should be re-elected.

|

| | | | | |

| CAREER HIGHLIGHTS

nGlossier, Inc. (consumer products)

—Chief Financial Officer, 2019 to 2022

nOath Inc. (a subsidiary of Verizon Communications)

—Chief Financial Officer, 2018 to 2019

nDropbox, Inc.

—Chief Financial Officer, 2015 to 2016

nMotorola Mobility Holdings, Inc. (a subsidiary of Google, Inc.)

—Chief Financial Officer, 2012 to 2014

nMarsh & McLennan Companies

—Executive Vice President & Chief Financial Officer, 2008 to 2012

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS

nOscar Health, Inc., since 2021

nBooking Holdings Inc., since 2019

FORMER PUBLIC COMPANY DIRECTORSHIPS nFedEx Corporation, 2015 to 2021 nKEYW Holding Corp., 2016 to 2019 OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT nFormer Visiting Professor of Cyber Studies, U.S. Naval Academy nFormer Member, U. S. Department of Defense Science Board, the U.S. Director of National Intelligence’s Strategic Advisory Group, the National Intelligence University’s Board of Visitors |

¢Independent Age: 69

Director since: 2024

|

| |

Key Experience and Qualifications: In light of Mr. Inglis’s broad and considerable experience in technology, cybersecurity and information security, public policy and government, the Board has concluded that Mr. Inglis should be elected. |

| | | | | |

| CAREER HIGHLIGHTS nCadore Group, LLC (management and IT consulting) —President, 2015 to present nNorthrop Grumman Corporation —Corporate Vice President, Operations, 2013 to 2015 —Corporate Vice President & President, Information Systems and Information Technology sectors, 2008 to 2012 —President of the Civilian Agencies Group, 2006 to 2007 —Vice President of Operations and Process, Information Technology Sector, 2003 to 2006 nTRW, Inc. —Various positions, 1979 to 2002, including Vice President of Information Systems and Processes OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS nNavient Corporation (non-executive chair), since 2014 OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT nBoard Member Emeritus, Smithsonian National Air & Space Museum, since 2012 nMember, Board of Visitors, University of Illinois, College of Engineering, 2009 to 2019 nSenior Advisory Group and Board Member, Northern Virginia Technology Council, 1990 to 2020 |

¢Independent Age: 74

Director since: 2015 COMMITTEES nCompensation and Management Resources (Chair) nRisk |

| |

Key Experience and Qualifications: In light of Ms. Mills’ experience with large and complex international operations, risk and financial management, information technology and cybersecurity, and her prior management of a significant line of business, the Board has concluded that Ms. Mills should be re-elected. |

18AIG 2024 PROXY STATEMENT

Proposal 1 – Election of Directors Director Nominees

| | | | | |

| CAREER HIGHLIGHTS nRocksolid Holdings, LLC (private equity) —Managing Director, 2007 to present nUnited States Golf Association —President, 2016 to 2018 —Vice President, 2014 to 2015 —Treasurer, 2013 to 2014 nGeorgia Research Alliance Venture Fund —Managing Director, 2012 to 2015 nChartwell Capital Management Co., Inc. —Managing Director, 1997 to 2007 nTribune Media Company, 1979 to 1995 —Chief Revenue Officer and Senior Vice President, Advertising and Marketing, The Baltimore Sun Company, 1992 to 1995 —Various positions, 1979 to 1992 OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS nAtlanta Braves Holdings, Inc., since 2023 nSynovus Financial Corp., since 2017 nLandstar System, Inc. (non-executive chair), since 1998 FORMER PUBLIC COMPANY DIRECTORSHIPS nCTS Corporation, 2010 to 2020 OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT nDirector, First Tee of Southeast Georgia, since 2018 nDirector and Member, Executive Committee of the College of Coastal Georgia Foundation, since 2015 nDirector, Boys and Girls Clubs of Southeast Georgia, since 2007 |

¢Independent Age: 67

Director since: 2023 COMMITTEES nCompensation and Management Resources nNominating and Corporate Governance |

| |

Key Experience and Qualifications: In light of Ms. Murphy’s significant business acumen, including her expertise in management development and risk management and experience in leading complex companies through strategic and organizational change, her experience as a seasoned public company director, as well as her background in media, communications and marketing, the Board has concluded that Ms. Murphy should be re-elected. |

AIG 2024 PROXY STATEMENT19

Proposal 1 – Election of Directors Director Nominees

| | | | | |

| CAREER HIGHLIGHTS nXL Group Ltd (insurance and reinsurance) —Senior Advisor to the Chief Executive Officer, 2017 to 2018 —Executive Vice President & Chief Financial Officer, 2011 to 2017 nErnst & Young LLP —Global Insurance Industry Leader, 1999 through 2011 nConsolidated International Group —President & Chief Executive Officer, 1998 to 1999 nZurich Insurance Group —Chief Financial Officer & Chief Operating Officer of Zurich Re Centre, 1993 to 1998 nErnst & Young LLP —Auditor, 1978 to 1993 OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS nNone OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT nChair, National Multiple Sclerosis Society, since 2022 |

¢Independent Age: 67

Director since: 2019 COMMITTEES nAudit (Chair) nRisk (Chair) |

| |

Key Experience and Qualifications: In light of Mr. Porrino’s professional experience related to the global insurance industry, as well as his experience in finance, accounting and risk management, the Board has concluded that Mr. Porrino should be re-elected. |

| | | | | |

| CAREER HIGHLIGHTS nGeneral Electric Company (multinational conglomerate) —Non-Executive Chairman, GE Gas Power, 2018 to 2020 —Vice Chairman, GE, 2005 to 2018 —President & Chief Executive Officer, GE Global Growth Organization, 2010 to 2017 —Various other senior positions, including: •President & Chief Executive Officer, GE Technology Infrastructure, 2005 to 2010 •Vice Chairman, GE Industrial, 2005 to 2007 •President and Chief Executive Officer, GE Energy, 2000 to 2005 •Senior Vice President, GE Power Systems, 2000 to 2003 •Vice President, GE Transportation Systems, 1997 to 1999 OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS nBaker Hughes Company, since 2017 OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT nGlobal Advisory Board Chair, Cambodian Children’s Fund, since 2023 nDirector, Li & Fung Limited, 2018 to 2020 nDirector, CDC Foundation, 2010 to 2015 nTrustee, Emory University, since 2006 nTrustee, Hamilton College, since 2003 |

¢Lead Independent Director Age: 67

Director since: 2022 COMMITTEES nNominating and Corporate Governance nCompensation and Management Resources |

| |

Key Experience and Qualifications: In light of Mr. Rice’s leadership experience, including leading complex, global organizations and his experience in finance, operations, business transformation and technology, the Board has concluded that Mr. Rice should be re-elected. |

20AIG 2024 PROXY STATEMENT

Proposal 1 – Election of Directors Director Nominees

| | | | | |

| CAREER HIGHLIGHTS nGlossier, Inc. (consumer products) —Chief Financial Officer, 2019 to 2022 nOath Inc. (a subsidiary of Verizon Communications) —Chief Financial Officer, 2018 to 2019 nDropbox, Inc. —Chief Financial Officer, 2015 to 2016 nMotorola Mobility Holdings, Inc. (a subsidiary of Google, Inc.) —Chief Financial Officer, 2012 to 2014 nMarsh & McLennan Companies —Executive Vice President & Chief Financial Officer, 2008 to 2012 OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS nOscar Health, Inc., since 2021 nBooking Holdings Inc., since 2019 FORMER PUBLIC COMPANY DIRECTORSHIPS nUlta Beauty, Inc., 2014 to 2019 nSirius XM Holdings, Inc. 2011 to 2018 OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT nDirector, Impossible Foods, Inc., since 2019 |

¢ Independent Age: 5556

Director since: 2023 COMMITTEES Ms. Wittman will receive her committee appointments after the 2023 Annual MeetingnAudit (Financial Expert)

nRisk |

| |

Key Experience and Qualifications: In light of Ms. Wittman’s experience as a seasoned public company director and senior financial executive in global organizations across a range of industries, including insurance, consumer products and technology, the Board has concluded that Ms. Wittman should be elected.re-elected. |

AIG 2023 PROXY STATEMENT13

Proposal 1 – Election of Directors Director Nominees

| | | | | |

| CAREER HIGHLIGHTS nAmerican International Group, Inc. —Chairman, since 2022 —Chief Executive Officer, since 2021; President, since 2020 —Executive Vice President & Global Chief Operating Officer, 2017 to 2021 —Chief Executive Officer, General Insurance, 2017 to 2019 nMarsh & McLennan Companies, Inc. (professional services) —Various senior positions, including: •Chairman for the Risk and Insurance Services segment, 2015 to 2017 •Chief Executive Officer of Marsh, LLC, 2011 to 2017 •President & Chief Executive Officer of Guy Carpenter, 2008 to 2011 •Various executive roles at Guy Carpenter, 2001 to 2008 nCORE Holdings, a GE Capital, portfolio company —Various roles, 1995 to 2001

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS nCorebridge Financial, Inc. (chair), since 20222021 OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT nDirector, The Michael J. Fox Foundation for Parkinson’s Research, since 2016 nDirector, New York Police and Fire Widows’ and Children’s Benefit Fund, since 2013 |

¢ Chairman & Chief Executive Officer Age: 5657

Director since: 2020 |

| |

Key Experiences and Qualifications: In light of Mr. Zaffino’s deep insurance expertise, leadership capabilities, financial and operational skills, and his continued exceptional performance as the CEO of the Company,AIG, the Board has concluded that Mr. Zaffino should be re-elected. |

Voting Recommendation

The Board of Directors unanimously recommends a vote FORAIG each of the nominees for election to the Board at the 2023 Annual Meeting.

142024 PROXY STATEMENT AIG 2023 PROXY STATEMENT21

Our Continuing Commitment to Effective and Robust Corporate Governance Practices

The Board is committed to effective corporate governance practices that are designed to maintain high standards of oversight, accountability, integrity and ethics while promoting the long-term interests of our shareholders. The Board continuously reviews and considers these practices to enhance its effectiveness.

Our governance framework enables independent, experienced and accomplished directors to provide advice, insight and oversight that will advance the interests of AIGthe Company and our shareholders. AIG hasWe have long strived to maintain sound governance standards, as reflected in our By-Laws, Certificate of Incorporation, Director, Officer and Senior Financial Officer Code of Business Conduct and Ethics, Corporate Governance Guidelines, committee charters, our systematic approach to risk management and in our commitment to transparent financial reporting and strong internal controls. The Board regularly reviews theseour corporate governance documents and makes modifications from time to time to reflect recent trendsdevelopments and investor feedback to ensure their continued effectiveness.

In 2023, the Board completed a comprehensive review of the committee charters and Corporate Governance Guidelines to broaden the responsibilities of the Lead Independent Director and strengthen our corporate governance practices, as described below.

We encourage you to visit the Leadership and Governance page of our website (www.aig.com) where you can access information about our corporate governance at AIG.governance.

Highlights of our governance framework follow.

The Board is Accountable and Committed to Shareholder Rights

nAll directors are elected annually

nMajority voting for directors in uncontested elections

nShareholders have proxy access

nShareholders can act by written consent

nShareholders holding 25 percent of voting stock can call special meetings

nRobustStringent share ownership requirements for directors and senior management

nNo hedging, short sales or pledging of AIG securities

nRobust Clawback Policypolicies that provide protections beyond those required by NYSE

nAnnual advisory vote on executive compensation

nActive and ongoing shareholder engagement

nShareholders have equal voting rights per share

nCertificate of Incorporation and By-Laws do not impose supermajority voting requirements

nAnnual Board, committee and director evaluations

nDirectors are subject to limitations on board service at other public companies

nShareholders have equal voting rights per share

nCertificate of Incorporation and By-Laws do not impose supermajority voting requirements

nDirectors' equity awards vest whenare not paid until they retire from the Board

nNo director attending less than 75 percent of regular Board and applicable committee meetings for two consecutive years will be re-nominated

nDirectors generally may not stand for election after reaching age 75

AIG 2023 PROXY STATEMENT22 15AIG 2024 PROXY STATEMENT

Corporate Governance Board Leadership Structure

The Board is Independent, Diverse and Qualified

nAll director nominees are independent, except for our Chairman & CEO, Mr. Zaffino

nAll standing committees are comprised entirely of independent directors

nIndependent directors meet regularly without management in conjunction with regularly scheduled Board and committee meetings

nRobust Lead Independent Director role with explicit responsibilities

nOf the ten director nominees, fivefour are women, two areone is racially diverse, one is a military veteran and one identifies as LGBTQ+

nThe NCGC continuously reviews the composition of our Board, taking into consideration the skills, experience and attributes of the existing directors, both individually and as a group

The Board and its Committees are Actively Engaged in Oversight

nThe Board, annually evaluates CEO performance

nThe Boardthrough its committees, oversees our strategic, capital and financial plans as well as our enterprise risk management succession planning(ERM) practices, including cybersecurity and climate risks